Looking for the auto insurance requirements in your state? Check out the chart below for the minimum coverage levels in states where Insurance Navy offers policies.

Some policies may include additional coverages unless you opt-out in writing. Some states have higher default coverage limits, but eligible drivers can carry only the state minimum if preferred.

| State | Requirements |

|---|---|

| Alabama | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| Alaska | (Auto insurance is optional for certain Alaska residents) $50,000 Bodily injury liability coverage per person $100,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| Arizona | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $15,000 Property damage liability coverage per accident |

| Arkansas | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| California | $30,000 Bodily injury liability coverage per person $60,000 Bodily injury liability coverage per accident $15,000 Property damage liability coverage per accident |

| Colorado | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $15,000 Property damage liability coverage per accident |

| Connecticut | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $25,000 Uninsured/underinsured motorist coverage (UM/UIM) per person $50,000 Uninsured/underinsured motorist coverage (UM/UIM) per accident |

| Delaware | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $10,000 Property damage liability coverage per accident $15,000 Personal injury protection (PIP) per person $30,000 Personal injury protection (PIP) per accident |

| Florida | $10,000 Property damage liability coverage per accident $10,000 Personal injury protection (PIP) |

| Georgia | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| Hawaii | $20,000 Bodily injury liability coverage per person $40,000 Bodily injury liability coverage per accident $10,000 Property damage liability coverage per accident $10,000 Personal injury protection (PIP) |

| Idaho | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $15,000 Property damage liability coverage per accident |

| Illinois | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $20,000 Property damage liability coverage per accident $25,000 Uninsured motorist coverage per person $50,000 Uninsured motorist coverage per accident |

| Indiana | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| Iowa | $20,000 Bodily injury liability coverage per person $40,000 Bodily injury liability coverage per accident $15,000 Property damage liability coverage per accident |

| Kansas | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $25,000 Uninsured/underinsured motorist coverage (UM/UIM) per person $50,000 Uninsured/underinsured motorist coverage (UM/UIM) per accident PIP: $4,500 Medical, $900/Month for 1 year disability/loss of income, $25/Day in-home services, $2,000 Funeral costs, $4,500 Rehab. Survivors: $900/Month for 1 year disability/loss of income, $25/Day in-home services. |

| Kentucky | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| Louisiana | $15,000 Bodily injury liability coverage per person $30,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| Maine | $50,000 Bodily injury liability coverage per person $100,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $50,000 Uninsured/underinsured motorist coverage (UM/UIM) per person $100,000 Uninsured/underinsured motorist coverage (UM/UIM) per accident $2,000 Medical payments coverage (MedPay) Single liability limit per accident of $125,000 |

| Maryland | $30,000 Bodily injury liability coverage per person $60,000 Bodily injury liability coverage per accident $15,000 Property damage liability coverage per accident $30,000 Uninsured/underinsured motorist coverage (UM/UIM) per person $60,000 Uninsured/underinsured motorist coverage (UM/UIM) per accident $15,000 Uninsured/underinsured property damage coverage per accident |

| Massachusetts | $20,000 Bodily injury liability coverage per person $40,000 Bodily injury liability coverage per accident $5,000 Property damage liability coverage per accident $20,000 Uninsured motorist coverage per person $40,000 Uninsured motorist coverage per accident $8,000 Personal injury protection (PIP) |

| Michigan | $50,000 Bodily injury liability coverage per person $100,000 Bodily injury liability coverage per accident $10,000 Property damage liability coverage per accident outside Michigan $10,000 Property damage outside MI $1M Property protection in MI $250,000 PIP ($ Lower for some Medicare/Medicaid). |

| Minnesota | $30,000 Bodily injury liability coverage per person $60,000 Bodily injury liability coverage per accident $10,000 Property damage liability coverage per accident $25,000 Uninsured/underinsured motorist coverage (UM/UIM) per person $50,000 Uninsured/underinsured motorist coverage (UM/UIM) per accident $40,000 Personal injury protection (PIP) |

| Mississippi | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| Missouri | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $25,000 Uninsured motorist coverage per person $50,000 Uninsured motorist coverage per accident |

| Montana | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $20,000 Property damage liability coverage per accident |

| Nebraska | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $25,000 Uninsured/underinsured motorist coverage (UM/UIM) per person $50,000 Uninsured/underinsured motorist coverage (UM/UIM) per accident |

| Nevada | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $20,000 Property damage liability coverage per accident |

| New Hampshire | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $25,000 Uninsured/underinsured motorist coverage (UM/UIM) per person $50,000 Uninsured/underinsured motorist coverage (UM/UIM) per accident $25,000 Uninsured/underinsured motorist property damage coverage $1,000 Medical payments coverage (MedPay) |

| New Jersey | $5,000 Property damage liability coverage per accident $15,000 Personal injury protection (PIP) |

| New Mexico | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $10,000 Property damage liability coverage per accident |

| New York | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $50,000 Liability coverage for death per person $100,000 Liability coverage for death per accident $10,000 Property damage liability coverage per accident $25,000 Uninsured motorist bodily injury coverage (UM) per person $50,000 Uninsured motorist bodily injury coverage (UM) per accident $50,000 Personal injury protection (PIP) |

| North Carolina | New Minimum requirements effective July 1, 2025 $50,000 Bodily injury liability coverage per person $100,000 Bodily injury liability coverage per accident $50,000 Property damage liability coverage per accident $50,000 Uninsured motorist coverage (UM) per person $100,000 Uninsured motorist coverage (UM) per accident $50,000 Uninsured motorist property damage coverage (UMPD) per accident |

| North Dakota | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $25,000 Uninsured/underinsured motorist coverage (UM/UIM) per person $50,000 Uninsured/underinsured motorist coverage (UM/UIM) per accident $30,000 Personal injury protection (PIP) |

| Ohio | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| Oklahoma | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| Oregon | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $20,000 Property damage liability coverage per accident $25,000 Uninsured motorist coverage (UM) per person $50,000 Uninsured motorist coverage (UM) per accident $15,000 Personal injury protection (PIP) |

| Pennsylvania | $15,000 Bodily injury liability coverage per person $30,000 Bodily injury liability coverage per accident $5,000 Property damage liability coverage per accident $5,000 Medical benefits |

| Rhode Island | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| South Carolina | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $25,000 Uninsured motorist coverage (UM) per person $50,000 Uninsured motorist coverage (UM) per accident $25,000 Uninsured motorist property damage coverage (UMPD) |

| South Dakota | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $25,000 Uninsured/underinsured motorist coverage (UM/UIM) per person $50,000 Uninsured/underinsured motorist coverage (UM/UIM) per accident |

| Tennessee | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| Texas | $30,000 Bodily injury liability coverage per person $60,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident |

| Utah | $30,000 Bodily injury liability coverage per person $65,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $3,000 Personal injury protection (PIP) |

| Vermont | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $10,000 Property damage liability coverage per accident $50,000 Uninsured/underinsured motorist coverage (UM/UIM) per person $100,000 Uninsured/underinsured motorist coverage (UM/UIM) per accident $10,000 Uninsured/underinsured motorist property damage coverage (UM/UIM-PD)per accident |

| Virginia | Optional auto insurance: Minimum limits apply; $500 Fee if no insurance. $50,000 Bodily injury liability coverage per person $100,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $50,000 Uninsured/underinsured motorist coverage (UM/UIM) per person $100,000 Uninsured/underinsured motorist coverage (UM/UIM) per accident $25,000 Uninsured/underinsured motorist property damage coverage (UMPD/UIMPD) per accident |

| Washington | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $10,000 Property damage liability coverage per accident |

| Washington, D.C. | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $10,000 Property damage liability coverage per accident $25,000 Uninsured motorist coverage (UM) per person $50,000 Uninsured motorist coverage (UM) per accident $5,000 Uninsured motorist property damage coverage (UMPD) per accident |

| West Virginia | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $25,000 Property damage liability coverage per accident $25,000 Uninsured motorist coverage (UM) per person $50,000 Uninsured motorist coverage (UM) per accident $25,000 Uninsured motorist property damage coverage (UMPD) |

| Wisconsin | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $10,000 Property damage liability coverage per accident $25,000 Uninsured motorist coverage (UM) per person $50,000 Uninsured motorist coverage (UM) per accident |

| Wyoming | $25,000 Bodily injury liability coverage per person $50,000 Bodily injury liability coverage per accident $20,000 Property damage liability coverage per accident |

Types of Required State Minimum Car Insurance Coverage

Car insurance laws vary across the US, with almost every state requiring at least minimum liability coverage in case of an accident.

However, the types of coverage and minimum limits vary from state to state and by insurance company. Some states require additional coverage to protect drivers and passengers.

- Liability Insurance: Almost every state requires liability insurance coverage, which pays for injuries and property damage to others in an accident where the insured driver is at-fault. This is represented by three numbers (e.g., 15/30/10): the maximum payout per person, total bodily injury per accident, and property damage. While these minimums meet the legal insurance requirements, experts recommend higher limits (e.g., 100/300/50) to protect against financial risk in a serious accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Required in about half the states, UM/UIM coverage pays for medical and vehicle repairs if an uninsured driver hits you or you are a victim of a hit-and-run driver. Some states only require bodily injury coverage for uninsured motorists, leaving property damage optional. Even in states where UM/UIM is not required, it’s a good safeguard against uninsured and underinsured drivers.

- Personal Injury Protection (PIP): In no-fault states, Personal Injury Protection (PIP) is mandatory and covers medical expenses, lost wages, and other costs for the policyholder and passengers, regardless of who was at-fault. A few at-fault states also require PIP. Even if not required, PIP can be a good addition for drivers who want broader financial protection beyond health insurance.

- Medical Payments Coverage (MedPay): Similar to PIP but with a narrower scope, Medical Payments Coverage (MedPay) pays medical bills for the policyholder, family members, and passengers injured in an accident, regardless of fault. MedPay does not cover lost wages or other expenses. MedPay is required in Maine, New Hampshire, and Pennsylvania.

While liability coverage, UM/UIM, PIP, and MedPay are required, comprehensive and collision coverage are never needed in any state. These coverages protect against vehicle damage from accidents, theft, vandalism, weather-related incidents, and animal collisions.

However, lenders require both collision and comprehensive coverage for leased or financed vehicles. Drivers can also choose from additional optional coverages like rental reimbursement, roadside assistance, and full-glass coverage, which they can add to their policies.

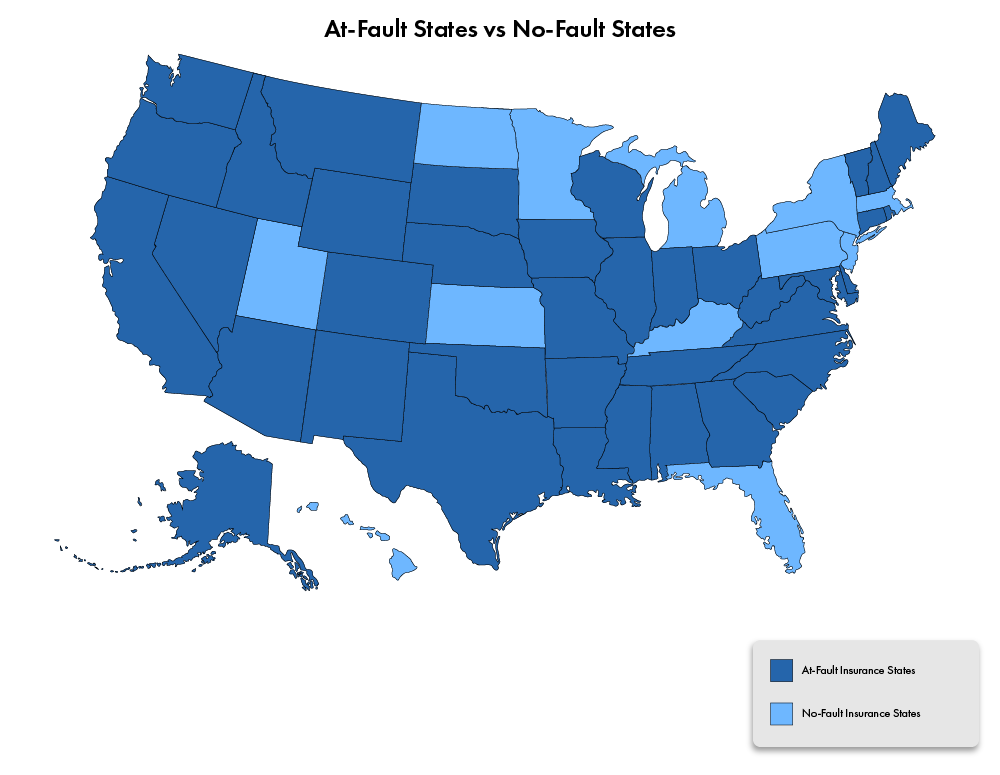

At-Fault vs. No-Fault States

Most states are at-fault (tort), meaning the driver at-fault in an accident must pay for the other party’s damages and injuries through their liability insurance.

In at-fault states, the injured party can file a claim against the at-fault driver’s insurance or sue for additional damages.

A no-fault insurance system requires drivers to use their Personal Injury Protection (PIP) to pay for medical expenses and other accident-related costs, regardless of fault.

No-fault insurance laws are designed to reduce legal disputes over accident claims and speed up compensation for injured drivers and passengers. The states that have no-fault insurance laws are listed below.

- Florida

- Hawaii

- Kansas

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Jersey

- New York

- North Dakota

- Pennsylvania

- Utah

Some no-fault insurance states allow drivers to opt-out of PIP so they can follow a traditional tort system instead. However, opting out may limit the driver’s ability to sue for certain damages.

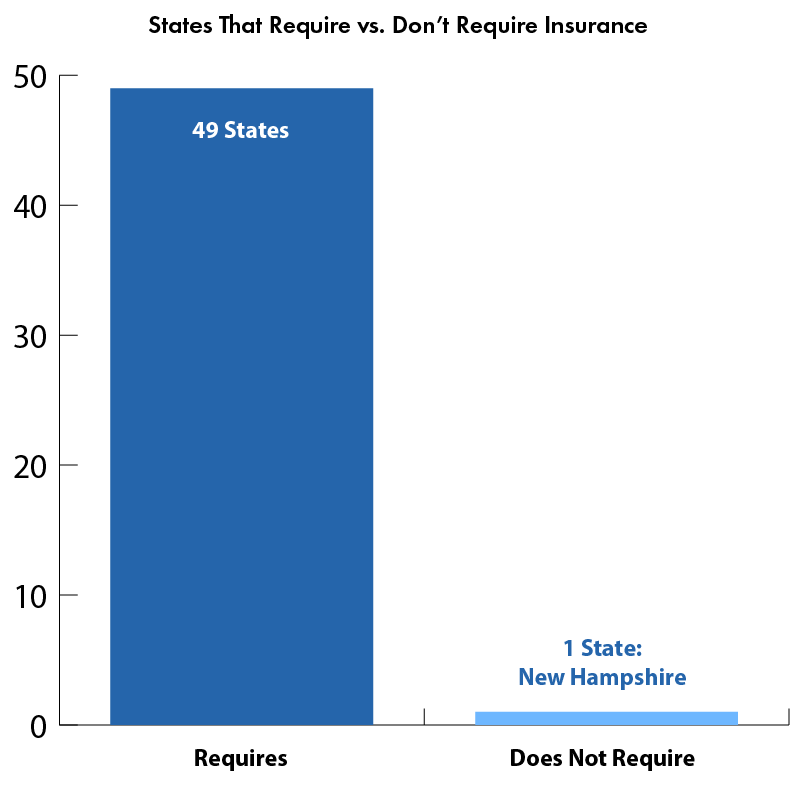

States That Require Car Insurance

Car insurance is required in 49 out of 50 states, with New Hampshire being the exception (they have alternative financial responsibility requirements).

Almost all states requiring auto insurance also require liability insurance coverage for bodily injury and property damage so drivers can pay for injuries and property damage to others.

However, Florida is an exception; they only require liability for property damage and Personal Injury Protection (PIP), not bodily injury liability insurance.

States That Don’t Require Car Insurance

New Hampshire is the only state that doesn’t require car insurance for most drivers. Unlike other states that require minimum liability coverage, New Hampshire allows drivers not to have an auto insurance policy if they can show they have sufficient funds to pay for damages and injuries in an accident.

Suppose an uninsured New Hampshire driver is at-fault in an accident and can’t pay for the damages. In that case, they may face license suspension, vehicle registration revocation, and lawsuits.

Although New Hampshire doesn’t require car insurance, drivers who choose not to purchase an auto insurance policy must still meet the state’s financial responsibility requirements, meaning they must show they can pay for liabilities.

Drivers with serious traffic violations like DUI convictions may be required to have insurance even if they would otherwise be able to drive uninsured.

Virginia has a unique alternative to traditional car insurance. While they require liability insurance coverage, drivers can opt-out of purchasing auto insurance by paying an annual “Uninsured Motorist Fee” of $500 to the Department of Motor Vehicles.

This fee doesn’t provide coverage; it allows a driver to drive uninsured. Suppose an uninsured Virginia driver is at fault in an accident. In that case, they must pay personally for all damages and medical expenses. Because of the financial risk, most Virginia drivers still choose to have insurance.

While these two states have an exemption, every other state requires some form of car insurance or proof of financial responsibility to pay for damages.

State Auto Insurance Coverage Limits Explained

State minimums set the legal floor for car insurance, but those limits are only basic. Experts recommend increasing your liability limits to protect yourself from financial risk in a serious accident.

When you get a car insurance quote, you’ll see a series of numbers separated by slashes—25/50/15 or $25,000/$50,000/$15,000 in your policy documents. But what do those numbers mean?

Those numbers are your coverage limits:

- The first number is the per-person bodily injury liability coverage in an accident.

- The second number is all injured parties' total bodily injury liability coverage.

- The third number is the property damage liability coverage per accident for damages to another person’s vehicle or property.

Every state has minimum coverage requirements, but those limits may not be enough to cover all expenses in a serious accident. You need to review the risks in your policy and choose limits that will give you enough financial protection for your situation.

In certain states, you may be mandated to purchase higher coverage than minimum limits if you have certain driving violations on your driving record.

Regardless of your insurance company, review your auto policy with your insurance agent to ensure you understand your coverage. If you have questions, be sure to ask your insurance agent.

Many financial advisors recommend increasing these limits to 100/300/50 for more coverage. High-net-worth individuals may also consider an umbrella policy that extends liability coverage beyond standard policy limits.

Beyond liability, Uninsured/Underinsured Motorist Coverage (UM/UIM) helps pay for damages if the at-fault driver is uninsured or underinsured. Minimum UM/UIM limits are often the same as state minimum liability limits.

Personal Injury Protection (PIP) is required in no-fault states. It covers medical expenses and lost wages no matter who is at-fault. Medical Payments Coverage (MedPay) is required in a few states and pays for medical bills after an accident.

Optional Auto Insurance Coverage

While meeting state minimums is required, many drivers choose extra coverages for more protection. Collision and comprehensive insurance cover damage to the policyholder’s vehicle. Comprehensive and collision coverage will pay for repairing or replacing the car up to its actual cash value (ACV).

Collision insurance covers accident-related damage, and comprehensive insurance covers theft, vandalism, natural disasters, and animal strikes. Lenders require both leased and financed vehicles.

Other policy options include rental reimbursement, which covers the cost of a rental vehicle. At the same time, your car is repaired after an accident, and roadside assistance provides emergency services like towing and battery jump starts.

Full-glass coverage is another common add-on that pays for windshield repairs or replacement with no deductible.

By comparing car insurance rates and adding optional coverages, you can get a policy that provides coverage beyond the minimum required by law while still fitting your budget.

Why does State Law require Car Insurance?

Car insurance laws exist so drivers are financially responsible for the accidents they cause. Liability insurance coverage ensures injured parties are paid for medical bills, vehicle repairs, and other damages so individuals and the state aren’t burdened.

Without mandatory insurance, accident victims would have to sue at-fault drivers directly, leading to long-drawn-out lawsuits and financial hardship.

Meeting the minimum coverage limit is required, but higher limits and extra protection can provide much peace of mind if you’re in an accident. Knowing state insurance requirements helps you make the right choice.