If you consider yourself a safe driver, you may only sometimes see the value of carrying car insurance. But accidents can happen to anyone, no matter how smart or safe you think you are on the road. One collision while uninsured is enough to wipe you out financially and even result in jail time.

Penalties range from tickets to weeks in jail, depending on the circumstances of your case. Accidents happen in seconds, and if you lack insurance, the penalties for driving without insurance can stay with you for years and years.

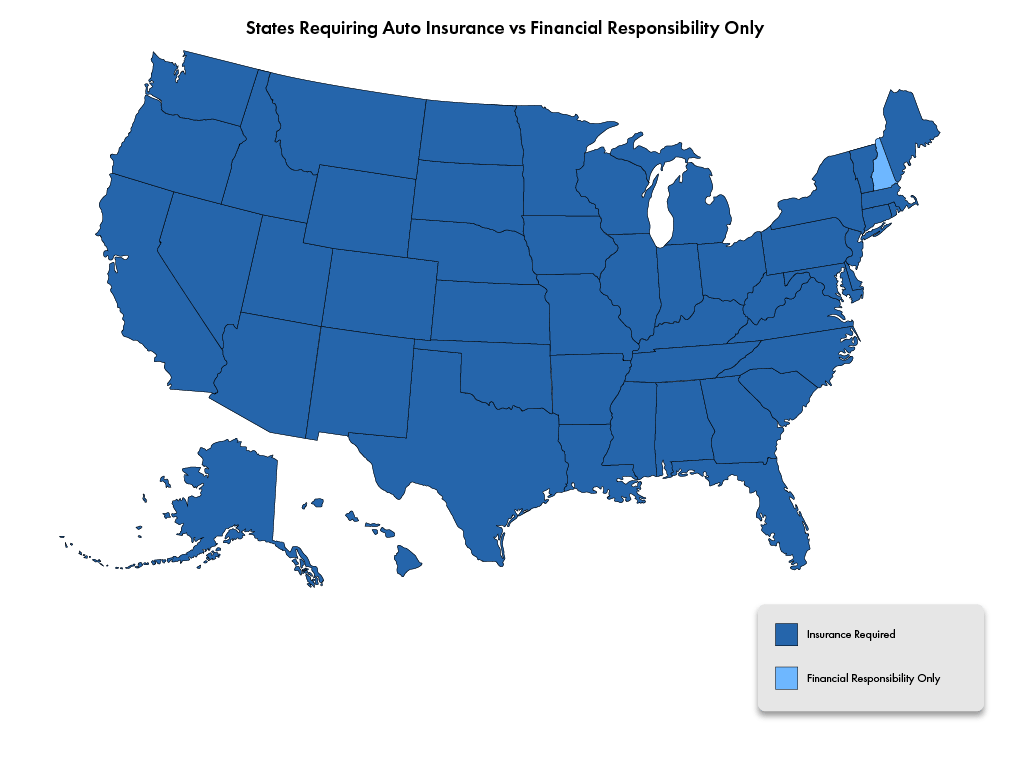

Can You Legally Drive Without Insurance?

For example, car insurance is required in almost every state, as well as a valid driver's license and license plate. If a car is in your name, you must have insurance unless you live in New Hampshire.

Even if you don't own a car but drive one, you must have insurance or be listed on the car owner's policy. New Hampshire doesn't require car insurance, but you must be able to prove financial responsibility for damages or injuries if you're at fault in an accident, and insurance is one way to do that.

Every state requires a minimum amount of car insurance for insured drivers. All states except Florida require bodily injury and property damage liability insurance. Florida law only requires property damage liability coverage.

Bodily injury liability covers the medical expenses for drivers and passengers in other vehicles if you're at fault in an accident, and property damage liability covers damage to another vehicle or personal property if you're found at-fault.

Before you buy car insurance, check your state's minimum requirements. Some states also require medical payments coverage or personal injury protection (PIP) to cover your medical expenses after a car accident.

Uninsured/underinsured motorist coverage is required in some states. The legally required coverage amounts are the minimum insurance required by your state. Consider more coverage based on your vehicle, financial situation, and driving habits.

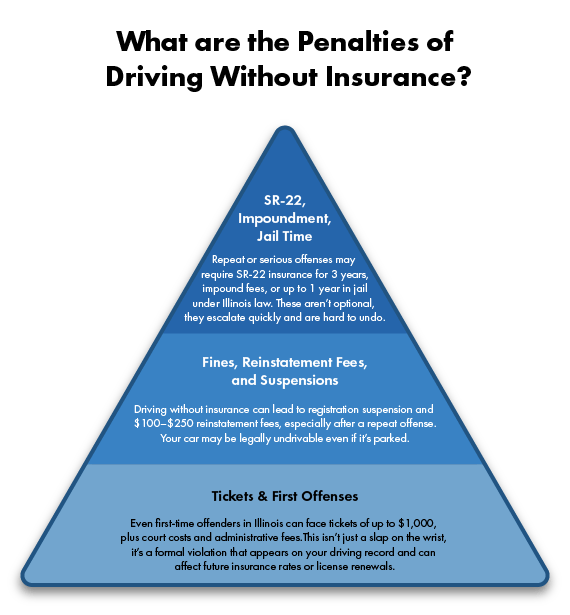

You will face severe penalties for driving without car insurance in nearly every state. These penalties are time-consuming and financially draining. Don't jeopardize yourself and any assets by ignoring your state car insurance requirements.

What are the Penalties for Driving Without Insurance?

If caught driving without insurance, you could be hit with severe penalties. Some of these may only be enacted if you fail to provide proof of insurance.

The legal consequences of driving without insurance vary depending on the damage caused, the number of subsequent offenses, and the state where you drive.

For example, in Illinois, Uninsured drivers driving without proof of insurance can face fines ranging from $500 to $1000, driver's license suspension, and vehicle impoundment. In Texas, you could just be facing penalties of almost $2,000.

Driving without valid insurance and getting into an accident can be disastrous for you and the other drivers involved. The situation is significantly exacerbated if the other driver does not have uninsured motorist coverage.

Vehicle repairs and medical bills from just one accident can be thousands and thousands of dollars, even millions.

Uninsured drivers could face significant fines for driving without insurance, such as SR-22 filing requirements, vehicle impoundment, and even jail time.

You could be facing any of the following if you are pulled over by a police officer and unable to provide proof of insurance:

Drivers License Suspension

The Department of Motor Vehicles will likely suspend your driver's license after you are caught driving without proper insurance coverage. The length of the suspension varies by state laws.

Some states end the suspension once you file an SR-22 certificate, while others set the suspension for a specific period. If your license is suspended, it can also be decided based on your involvement in the collision.

Suppose you are found to be the at-fault driver and thus financially responsible. In that case, your state may revoke your driving privileges on that fact alone. Other states may be more strict if you're caught driving a vehicle without insurance and suspend your license and vehicle registration.

Tickets, Fines, and Fees

Some states have financial consequences as high as $2,000 for driving without insurance. What you will be paying can depend on your state, the circumstances of your offense, and how many prior violations you have.

Expect to pay reinstatement fees to get back your license if it is suspended for driving without insurance. If you are required to file an SR-22 form, you must also pay filing fees. It is important to note that fees and fines regarding the violation are not the only expenses.

SR-22 Insurance Requirements

You must have SR-22 insurance coverage following a major traffic violation, especially after driving without insurance. This will also be the case if you cause an accident while uninsured.

SR-22 insurance isn't insurance but proof of financial responsibility showing that you carry at least the minimum amount of auto insurance in your state. You will have to find an insurance provider to purchase a policy from, and they will handle the filing. Filing may come with fees set by your insurance company. You can also expect to pay some hefty premiums due to their negligent history.

What Happens if You Get Pulled Over By the Police Without Insurance?

Getting pulled over for driving without valid insurance, even as a first-time offender, will usually result in a ticket and fines of up to $5,000 in some states. Many states will also suspend your license for being uninsured, even for a first offense.

The suspension may be lifted after a certain period or when you provide proof of insurance or file an SR-22 with the state.

Sometimes, your vehicle will be towed, and you can't get it back until you pay the fine and provide proof of insurance. Knowing how to get your vehicle out of impound and how tickets affect car insurance rates is key. It's essential to carry your insurance card for proof of insurance to a police officer.

What Happens if You Get in an Accident Without Insurance?

If you drive without car insurance and get into an accident, the financial and legal consequences can be significant. Without insurance coverage, you could be personally responsible for all damages. These damages include the other car, your car, medical bills, legal fees, and state penalties. The consequences of getting into an accident while driving uninsured are listed below.

1. Liability for Damages

If you're at fault in the accident, you may have to pay for the damages to the other vehicle. The costs can be high in states where at-fault drivers must pay for damages. For example, In 2022, the average auto liability claim for property damage was $6,551, while collision claims averaged $5,470.

2. Cost of Repairing Your Vehicle

Even if the damage to your vehicle is minor, repair costs can increase quickly. If the accident affects multiple parts of your car, the costs could be higher than expected. If your vehicle is totaled, replacing it without insurance could be challenging.

3. Medical Expenses for Injuries

You could be liable for their medical expenses if injuries occur—whether to passengers in your vehicle or the other party. In 2020, the average auto liability claim for bodily injury was $20,235, while the average claim for property damage was $4,711.

Your health insurance may cover some of your medical expenses. However, you'll still be responsible for deductibles and co-pays, which would not be covered under an auto policy.

4. Legal Consequences

The other driver may sue you for damages if you're found at-fault for the accident. Without auto insurance, you'll be responsible for paying for your legal defense and any settlements or judgments against you.

5. State Penalties for Driving Uninsured

Most states require drivers to carry auto insurance, and failing to do so can result in severe penalties, including:

License suspension or revocation

Fines from $75 to $1,500

Suspension of your vehicle registration

Vehicle impoundment

Possible jail time

Additional fees to reinstate your driver's license

6. Financial Burden of the Accident

An accident can be expensive, especially without insurance to cover the costs. The financial strain can be crushing, making it challenging to pay for repairs, medical bills, or legal fees out of pocket.

How To Get Car Insurance After a Lapse in Coverage

Simply letting your car insurance policy lapse is not a crime. This is perfectly legal to do and part of your right as a consumer. However, if you let your car insurance coverage lapse, do not drive your car without insurance.

Remember that insurance providers do not like to see you have a history of insurance coverage lapses. While you can do it, they may find it to mean you are unreliable or even a high-risk driver. Your insurability risk goes up with such a blemish on your insurance history.

When you go to repurchase insurance, you may be paying much more than you originally were. Your car's registration can be revoked if you let your insurance policy expire. So, while you can let your insurance go away, you may not want to.

Can You Drive a Car You Don't Own Without Insurance?

You may find yourself driving a vehicle you do not own in two instances: borrowing someone else's car and needing a rental car. During these moments, you may need clarification about your insurance coverage while operating such vehicles.

When borrowing someone else's car, it is essential to remember that car insurance is tied to the vehicle, not the driver. This means that if you are driving someone else's vehicle, the owner's insurance policy will have to cover any accidents that can occur.

When renting a vehicle, most rental companies protect it with the state's mandatory minimum amount of car insurance. You do not have to purchase extra auto insurance. However, it may be wise to do this if you already have car insurance and frequently rent vehicles.

Since mandatory insurance typically only covers the other driver in an accident, you will want protection for your vehicle. Your auto insurance policy will still apply in most cases when renting a car.

How to Find Affordable Car Insurance When Uninsured

Hundreds, even thousands, of drivers do not carry car insurance despite being required. Many drivers cite various reasons for not having insurance coverage, from not being able to afford it to believe the cost outweighs the risks.

However, driving without insurance can harm your livelihood and financial position. It is reckless to drive without car insurance. Suppose you struggle to afford car insurance coverage. In that case, Insurance Navy is here to help you find the best policy at the lowest price.

Call us at 888-949-6289 to speak with an insurance agent or get free cheap car insurance quotes online!