Hey there, young drivers of Illinois! Are you feeling overwhelmed about car insurance? Don’t worry, we’ve got your back. Let’s dive into everything you need to know about finding the best car insurance for young drivers, considering your individual needs, driving frequency, coverage options, and available discounts – and why Insurance Navy should be your top choice.

The Lowdown on Car Insurance for Teens & Young Drivers in Illinois

Figuring out car insurance can be a daunting task, especially for young drivers in Illinois. It’s important to get car insurance quotes from multiple companies to find the best rates.

With the myriad of options available and the various factors affecting insurance rates, it’s crucial to have a comprehensive understanding of what car insurance entails and how to secure the best possible rates. This guide aims to demystify car insurance for young drivers in Illinois, providing you with all the information you need to make an informed decision.

Understanding Car Insurance in Illinois

Car insurance is a contract between you and an insurance company that protects you against financial loss in the event of an accident or theft. In exchange for your premium payments, the insurance company agrees to pay your losses as outlined in your policy. The primary components of car insurance policies include liability coverage, uninsured motorist coverage, and personal injury protection.

It’s crucial to understand the dangers of distracted driving, especially for young drivers. Safe driving practices, including the use of apps to monitor and minimize distracted driving behavior, are essential to reduce risks on the road.

First things first: as a young driver in the Prairie State, you’re probably aware that car insurance can be pretty pricey. But why is that?

Illinois Car Insurance Requirements

In Illinois, it is mandatory for any young driver to have liability insurance, uninsured motorist bodily injury coverage, and personal injury protection. These coverages ensure that you are financially protected in the event of an accident, whether it’s your fault or not.

Minimum Coverage Limits

The state of Illinois requires the following minimum coverage limits:

- $25,000 bodily injury per person

- $50,000 bodily injury per accident

- $20,000 property damage

These limits represent the least amount of car insurance for teens that you can have to legally drive in Illinois. However, it is often recommended to carry higher limits to provide better protection.

A Quick Overview of Average Car Insurance Costs for a Young Driver In IL

Lets take a look at the cold, hard numbers…

Here’s the scoop on car insurance for young drivers in Illinois:

- If you’re 20 years old, you’re looking at an average annual premium of $3,535 for full coverage.

- By the time you hit 25, that number drops to $2,854.

Ouch, right? But don’t panic! There are ways to bring those costs down, and Insurance Navy is here to help.

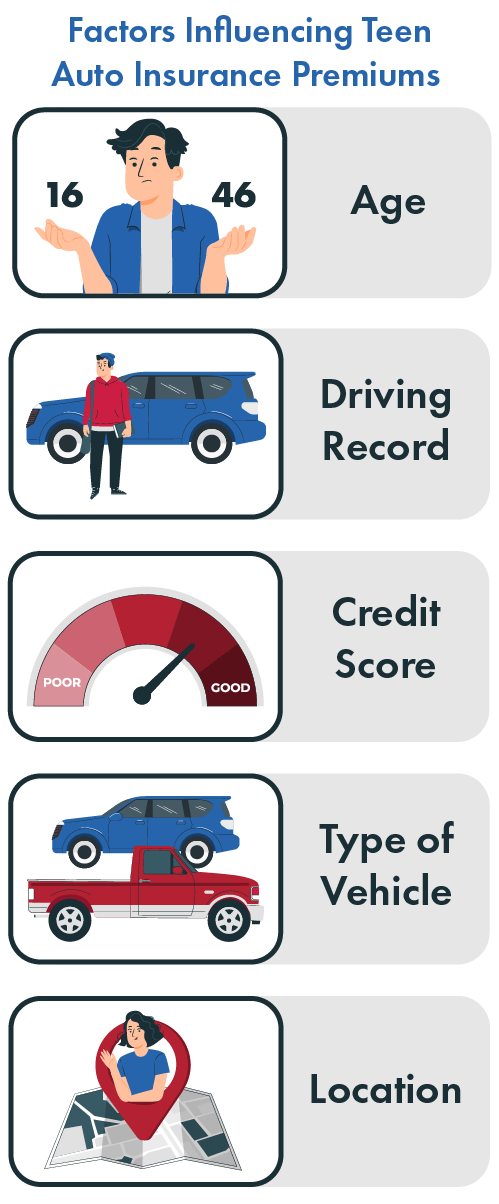

What’s Affecting Your Car Insurance Rates as a Teen Driver?

Several factors come into play when determining teen driving insurance premiums:

- Age (sorry, but it’s true!). Young drivers are statistically a higher risk for car insurance companies

- Driving record. It is especially important for teen drivers with no or little driving history to maintain a clean driving record. Safe driving habits go a long way when trying to keep the costs of your auto insurance policy down.

- Credit score (adulting is hard, we know). As a teen driver, having good credit is another way to show maturity, sensibility, and responsibility to insurance companies.

- Type of vehicle (that sports car might not be the best idea). Teen drivers should consider safer vehicles instead of fast sports cars.

- Location (city drivers, we feel your pain). There’s probably not much you can do here as a teen driver still living at home, but facts are facts and zip codes matter.

Why Insurance Navy Stands Out as a Clear Winner for Teen Drivers in Illinois

Now, you might be wondering, “Why should I choose Insurance Navy for my car insurance policy?” Great question! Let’s break it down:

- Competitive Rates: We understand that as a young driver, every dollar counts. That’s why we work hard to offer some of the most competitive rates for auto insurance in Illinois.

- Tailored Coverage: We know that one size doesn’t fit all. Our expert agents will work with you to create an auto insurance policy that fits your unique needs and budget.

- Illinois Expertise: As locals, we understand the specific insurance requirements and challenges faced by Illinois drivers. We’ve got you covered, from Chicago to Carbondale!

- Awesome Discounts: We offer a variety of discounts tailored specifically for young drivers. (More on that in a bit!)

Top-Notch Customer Service: Have a question at 2 AM? No problem! Our 24/7 customer support is always here for you.

Car Insurance Discounts That’ll Make You Smile

At Insurance Navy, we love rewarding our young drivers with car insurance discounts that keep auto insurance premiums down. Below are a few auto insurance discount options that (if available) can help keep car insurance costs down.

Good Student Discount

Hitting the books hard? A good student discount could pay off big! Maintain a B average or better, and you could save 10% to 25% on your premiums. That’s like getting paid to study!

Driver Training Discounts

Complete a driver’s ed course or a safe driving program, and watch your rates drop. It’s a win-win: you become a safer driver and save money!

Student Away at School Discounts

Heading off to college without your car? Let us know, and we might be able to lower your parents' premiums. They’ll thank you later!

Choosing the Right Car Insurance Coverage

Feeling confused about all the insurance jargon? No worries! Here’s a quick rundown on auto insurance and how each type of car insurance policy can impact your coverage and car insurance premiums.

- Liability Coverage: This is the bare minimum required by Illinois law. It covers damage you might cause to others. If the goal is to keep car insurance cost down, this is your best bet.

- Collision Coverage: This protects your own car in case of an accident. Given that teen drivers in Illinois are more prone to accidents, it may be prudent to consider this coverage for your teen driver.

- Comprehensive Insurance: Think of this as protection against everything else – theft, vandalism, falling trees, you name it! Although car insurance premiums for this type of auto insurance are higher, it is often a great choice if you have a newer vehicle driven by a new driver.

- Personal Injury Protection: This car insurance covers medical expenses for you and your passengers.

At Insurance Navy, we’ll help you understand what each type of coverage means for you, your teen driver, and your wallet.

Adding a Teen Driver to Your Policy

Parents, listen up! Adding your teen to your policy can often be cheaper than getting them a separate one. Plus, with Insurance Navy, you’ll get:

- More comprehensive coverage

- Better customer service

- Peace of mind knowing your teen is well-protected

Illinois-Specific Considerations

Did you know that Illinois has a graduated licensing system for teen drivers? Or that you need at least $25,000 in bodily injury liability coverage? Don’t worry if you didn’t – that’s what we’re here for! At Insurance Navy, we’re experts in Illinois insurance laws and regulations, so you don’t have to be.

Tips for Saving Even More

Want to stretch your dollar even further? Try these Insurance Navy approved tips:

- Maintain a spotless driving record

- Consider a higher deductible (but make sure you can afford it if needed)

- Bundle your car insurance with other policies (like renters insurance)

- Drive a safe, reliable car (sorry, no street racing allowed!)

Ready to Get Started?

So, there you have it – everything you need to know about car insurance for young drivers in Illinois, and why Insurance Navy is your best choice. We offer competitive rates, tailored coverage, awesome discounts, and unbeatable customer service.

Don’t waste time and money with other providers. Get a quote from Insurance Navy today and see how much you could save! Remember, when it comes to protecting yourself on the road, you’re not just buying insurance – you’re investing in peace of mind.

Call us, visit our website, or stop by one of our offices for a free Chicago car insurance quote. We can’t wait to welcome you to the Insurance Navy family!

Auto Insurance FAQs

What is the minimum car insurance coverage required in Illinois?

Illinois requires drivers to have a minimum of $25,000 bodily injury per person, $50,000 bodily injury per accident, and $20,000 property damage.

How do I get the cheapest car insurance in Illinois?

To get the cheapest car insurance in Illinois, compare quotes from multiple providers, take advantage of available discounts, and maintain a good driving record and credit score.

What discounts are available for young drivers?

Common discounts for young drivers include good student discounts, defensive driving course discounts, multi-car discounts, and bundling discounts.

How does my credit score affect my car insurance rates?

A good credit score can lead to lower car insurance rates, while a poor credit score can result in higher premiums.

Can I bundle my car insurance with other policies for a discount?

Yes, many insurance companies offer discounts for bundling car insurance with other types of insurance policies, such as home or renters insurance.