What's a Car Insurance Deductible?

A car insurance deductible is the amount of money you pay out-of-pocket to fix your vehicle before your auto insurance policy pays the rest. Every time a covered claim is filed to your insurance provider, you have to pay your chosen deductible, and once you do, the insurer will proceed to cover the rest of the charges.

Car insurance deductibles are part of some of the more standard coverages. Common deductibles include, but are not limited to, collision and comprehensive coverage, as well as uninsured motorist property damage and personal injury protection coverage.

Standard deductible amounts you'll typically see are $250, $500, $1,000, $1,500 or $2,000. Which deductibles are offered will depend on the insurance provider and the state you live in.

Insurers like Progressive and Geico offer smaller deductibles in some states and larger ones in others. USAA (for active military members) which cuts the deductible on comprehensive coverage down to $50.

Some states like New York and Michigan actually cap maximum deductibles at $2,000 for collision due to local insurance regulations.

How does a Car Insurance Deductible Work?

After filing a claim with your auto insurance company, the cost of repairs for your car is calculated by the total cost of covered repairs subtracted from your car insurance deductible. Your insurance provider will then pay for the difference.

For example, let's say your vehicle gets T-boned at a busy intersection, and you lose one of its passenger doors.

Typically, the at-fault driver's liability coverage would take care of everything, but in this case, they don't have insurance. After all is said and done, the door needs to be replaced, so you submit your claim.

You receive a quote for a new car door, and the entire cost is $2,000. Now, let's say you picked the $500 deductible option from your current collision coverage. Based on this information, your out-of-pocket costs are only $500. After paying your car insurance deductible, your insurance policy will pay the remaining $1,500, and you get your new car door.

Each auto insurance coverage you have will charge you their respective insurance deductibles separately if they go into effect.

So, if the accident you suffered turned out to be even worse and you ended up sustaining bodily injuries, you now have to pay another deductible for your personal injury protection (PIP). Medical Payments Coverage pays for medical bills on top of what you owe for the collision deductible.

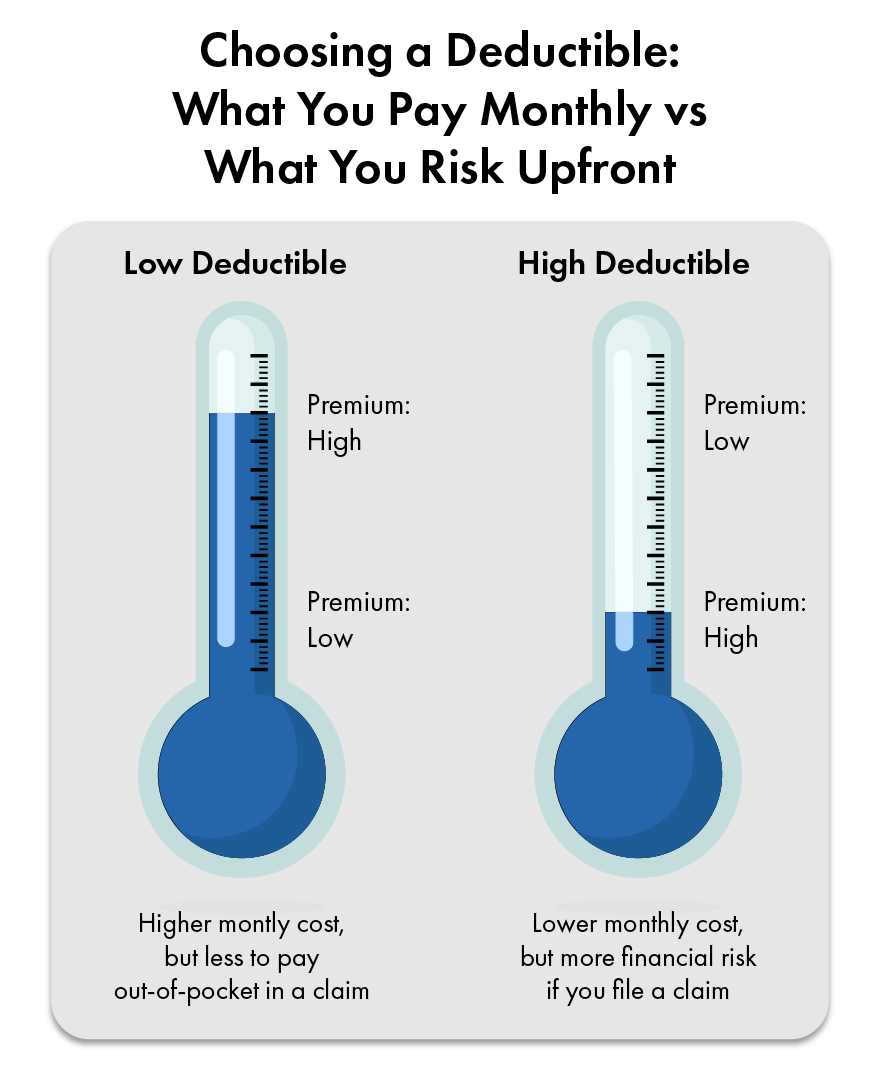

High Deductible vs Low Deductible: What's the Trade-Off?

Increasing your deductible from $500 to $1000 will typically knock your premiums down somewhere between 15-30%. Most of the bigger carriers like Progressive, State Farm, and Geico are providing this rate reduction on auto policies.

For example, if you're paying $1200 a year with a $500 deductible, you could get a reduced rate of $900-$1020 a year with a $1000 deductible. That's a savings of $180-$300 a year.

Carriers and coverage types can affect the amount of available deductibles. You'll generally find that collision and comprehensive deductibles are offered at $250, $500, $1000, $1500, and $2000.

According to the Insurance Information Institute, 71% of drivers just go with either $500 or $1000 deductibles.

Windshield coverage has its own rules for your auto policy. Progressive, Liberty Mutual, and Travelers will all give you a zero dollar deductible for windshield replacement in places like Arizona, Connecticut, Florida, Kentucky, Massachusetts, Minnesota, New York, and South Carolina.

In these states, the law actually requires the insurer to replace your windshield for free. The popular windshield company, Safelite, partners with Allstate, Nationwide, and USAA to process zero dollar deductible windshield claims in those states.

When Do You Pay the Deductible for Car Insurance?

When you have to pay a car insurance deductible, it depends on the type of claim and coverage. Generally, you have to pay a deductible whenever you file a claim with your insurance company for damage to your vehicle, no matter who's at fault.

Deductibles most commonly apply to comprehensive and collision coverage but can also apply to personal injury protection (PIP) or uninsured/underinsured motorist property damage coverage.

However, there are times when you don't have to pay the deductible. If another driver is at-fault in the accident, their insurance should cover your vehicle repair costs, and you won't have to pay a deductible.

If your claim is filed under liability insurance coverage, which pays for property damage or injuries you cause to others, you don't pay a deductible as long as the costs are within your coverage limits.

Some insurance companies offer diminishing deductible programs which reduce your deductible each year you drive safe and don’t make any claims.

Allstate's Your Choice Auto reduces your deductible by $100 a year for up to $500 after 2 claim free years.

American Family's Platinum Choice does the same thing, but decreases your comprehensive and collision deductible by $50 every 6 months. After 5 years, you can get a zero dollar deductible with them.

Safeco's Accident Forgiveness with Disappearing Deductible cuts $100 off your deductible a year for a maximum of 5 years.

What Car Insurance Coverages Don't Require Deductibles?

Liability and uninsured motorist coverage are not subject to deductibles, as they focus on covering third-party damages.

Deductibles are typically involved in claims where the damages involve your vehicle. Medical expenses and all other health coverage are also normally free of deductibles (with the exception of PIP).

While there are no deductibles with these coverage products, they do have their limits depending on which insurance premium you choose. Once the plan reaches the coverage limit, the rest of the payments fall onto you.

How Should I Choose a Car Insurance Deductible?

Ultimately, the deductible you choose really depends on your claims history, how much you have in emergency savings, and what your vehicle is worth.

Consumer Reports recommends choosing a deductible equal to 2-5% of your vehicle's value. If your vehicle is worth $30,000, that suggests a $600-$1500 deductible.

The average auto insurance claim is around $4711 for collision and $2000 for comprehensive, according to the National Association of Insurance Commissioners.

Drivers who file claims every 3-5 years get a better value with lower deductibles ($250-$500). Drivers who only file claims every 10+ years save more with higher deductibles of $1000-$2000.

Having some emergency savings on hand really matters if you have a higher deductible. Financial planners say you should try to keep 3-6 times your deductible amount set aside in a savings account. If you've got $3000 in emergency savings, a $500-$1000 deductible is probably a good bet for you. Consider all these factors listed below.

Your driving record and driving frequency

Driving record and driving frequency can also play a role in choosing a deductible. Drivers with clean records (no accidents or traffic tickets for 3+ years) can qualify for a safe driver discount of 20-30% with insurers like Nationwide, Travelers, and American Family Insurance. That can make higher deductibles ($1000-$2000) more attractive.

Low-mileage drivers who drive under 7,500 miles on their vehicle each year can get usage based discounts of 25%-30% per year through programs like Progressive Snapshot, Allstate Drivewise, and State Farm Drive Safe & Save.

According to the IIHS, drivers who commute less than 10 miles a day are 40% less likely to get into a collision than drivers who commute 20+ miles. Higher deductibles are a good choice for people who work from home.

Age and condition of your car

Vehicles over 10 years old with a value under $5,000 usually work out financially with a higher deductible ($1000-$2000) or dropping collision and comprehensive coverage.

For example, a 2014 Honda Civic that's worth $4500 will cost you around $800 a year with a $500 deductible for full coverage. If you increase that deductible up to $1500 your annual premiums are reduced by $550 a year.

If repair costs exceed 70-80% of your vehicle's value insurers like Farmers, Hartford, and CNA are likely to declare it a total loss.

Leasing Company Terms

If you're leasing your car, the leasing company might ask you to get full coverage and specific deductible amounts. The same applies to any other company providing you with auto loans or financing options. This is usually the only time you won't have the freedom to select the right car deductible for you.

When Are You Not Required to Pay Car Insurance Deductibles?

You won't have to pay a deductible when the driver at fault in an accident is covered by their liability insurance through the insurance company paying for the damages. This is a process known as subrogation. Some insurers may also choose to waive deductibles if you've got a specific endorsement added to your policy.

Deductible waiver endorsements differ from one insurance provider to another. For example, Progressive offers a Deductible Savings Bank, which cuts your collision deductible by $50 a year (up to a total of $500) if you don’t file a claim for an entire year . Another example is Liberty Mutual's Accident Forgiveness, which will waive rate increases after your first at fault accident if you've had no claims for at least 5 years. Nationwide's Vanishing Deductible reduces your comprehensive and collision deductibles by $100 a year up to a total of $500 if you are claim free for several years.

Full glass coverage removes any need for a deductible on your windshield except in states that don't charge a deductible at all. In Texas, California, and Illinois, a new windshield will cost you between $250 and $400, Geico charges an extra $10-$15 per month to have your windshield replaced with a full glass coverage add on. State Farm bundles full glass coverage into comprehensive policies in Nevada and Ohio for free.

Zero dollar deductible policies are available but they cost a lot more on your policy premiums. Anywhere from 25-40% more per year. For example Esurance and The General offer zero dollar deductibles for comprehensive and collision coverage in Florida, Georgia and Texas. The premiums cost at around $2,400-$3,200 a year compared to $1,600-$2,000 a year for a standard $500 deductible policy.

State mandated PIP (personal injury protection) deductible requirements differ too. In Florida there's actually no deductible for the first $10,000 of PIP coverage, thanks to Florida Statute 627.736. In Michigan PIP deductibles can be as low as $250 and as high as $1,000 under MCL 500.3107. In Kansas you're not allowed to have a PIP deductible of more than $2,000 per KSA 40-3107.

Frequently Asked Questions

Do I Have to Pay the Deductible if I Am Not at Fault in an Accident?

Is My Car Insurance Deductible Applied Per Accident or Per Year?

What's the Difference Between Collision and Comprehensive Deductibles?

Collision Insurance Deductible: A collision deductible is for damages from a collision with another vehicle or an object (guardrail, tree, etc.)

Comprehensive Insurance Deductible: A comprehensive deductible is for non-collision events (theft, vandalism, fire, natural disasters)