What is the ILIVS Illinois Insurance Verification System?

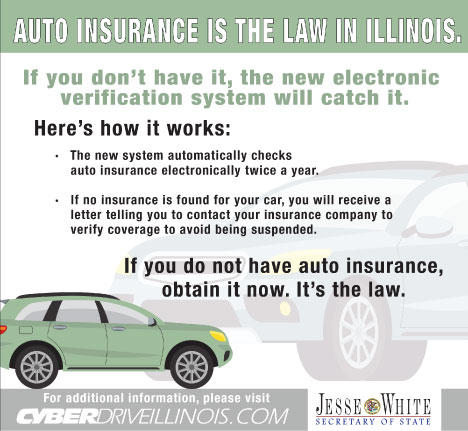

The ILIVS Illinois Insurance Verification System is an electronic liability insurance verification program introduced in 2020 to ensure that all vehicles registered in Illinois comply with the Mandatory Insurance Law (625 ILCS 5/7-601).

It was mandated in 2019 and is designed to reduce the number of uninsured motorists in the state. ILIVS electronically connects with all insurance companies that offer vehicle liability policies in Illinois.

ILIVS went live on July 1, 2021, and makes it easier for insured drivers to stay compliant and identify uninsured vehicles more efficiently.

How Does ILIVS Work?

ILIVS verifies the insurance status of every registered vehicle twice a year. It's an electronic process that's connected to all insurance providers in the state.

If a vehicle has valid insurance, no action is required from the registered owner, as the system verifies coverage directly with the insurer.

If the initial verification attempt fails to find insurance coverage, it is checked again in 30 days.

After that, if the vehicle is still found to be uninsured, the Secretary of State's office will send a notification letter to the owner requesting proof of insurance.

Failure to provide valid proof of insurance can result in penalties, including driver's license suspension.

ILIVS strengthens enforcement and gets rid of the need to visit a Driver Services Facility to prove insurance coverage manually.

What Should I Do If I Get an Insurance Verification Letter from the Secretary of State?

If you get a registration suspension letter from the Secretary of State with the subject "ACTION REQUIRED: REQUEST FOR INSURANCE VERIFICATION," do not visit the DMV.

Call Insurance Navy at 888-949-6289 instead.

If you were insured on the requested date verification, call 888-949-6289, and we'll take care of the verification process instantly.

If you were uninsured on the requested verification date, call us for a free quote 888-949-6289 and provide the reference number from your state notice. Lost your letter or ILIVS reference number? No problem! We can retrieve your information using your Vehicle Identification Number (VIN).

Penalties for Non-Compliance with Illinois' Mandatory Insurance Law (625 ILCS 5/7-601)

As of July 1, 2021, vehicle owners who fail to maintain valid auto insurance will face harsh penalties, including license plate suspension and fines.

ILIVS Fines & Penalties for First-Time Offenders:

License plate suspension until proof of insurance is provided.

$100 license reinstatement fee to restore registration.

$500 minimum fine for driving without insurance.

Penalties for Repeat Offenders and Second Suspensions Under ILIVS

If you violate Illinois' Mandatory Insurance Law a second time, the penalties get much worse.

A second suspension notice means more expensive consequences, so you must address insurance coverage gaps immediately.

1. Repeat Offender Consequences

If your license plate is suspended for 4 months, your vehicle is unregistered and cannot be driven on public roads.

A $100 reinstatement fee to get your registration back after the suspension period.

A minimum $1,000 fine for driving a vehicle while the plates are suspended due to a previous insurance violation.

2. Additional Consequences:

If you get a ticket for a traffic violation or get into an accident while uninsured, you may face the following fines listed below.

$500 minimum fine for driving without insurance.

$1,000 minimum fine for driving with plates suspended from a prior insurance violation.

The longer you're uninsured, the more major consequences you'll face. For multiple violations, you'll get longer suspension periods, higher reinstatement fees, and more legal penalties.

Ignoring Illinois insurance laws can lead to more legal action, significant fines and other consequences.

To avoid these penalties, ensure your vehicle is insured, and your coverage is electronically verified through ILIVS.

Contact Insurance Navy today for a free quote for Cheap Car Insurance in Chicago within minutes.

Call 1-888-949-6289, email customerservice@insurancenavy.com, or get free car insurance quotes online.