All drivers in Illinois are required to carry valid auto insurance coverage. This protects you and other drivers from financial losses. Your insurance company will help cover the cost of accidents and other damage in the event of a claim.

Illinois insurance law requires the at-fault driver (responsible for the accident) to pay for the damage. Insurance Navy can help you find the right policy to satisfy Illinois minimum insurance requirements.

What are the Minimum Coverage Limits in Illinois?

Illinois auto Insurance requirements include liability coverage and uninsured/underinsured bodily injury coverage. Driving without proof of insurance may result in fines and license suspension.

| Coverage type | Illinois minimum | Why you might want more |

|---|---|---|

| Bodily Injury (BI) | $25,000 / $50,000 | Hospital bills can exceed $50k quickly |

| Property Damage (PD) | $20,000 | Most new vehicles cost well above $20k |

| Uninsured / Underinsured Motorist (UM/UIM BI) | $25,000 / $50,000 | Roughly 13% of IL drivers are uninsured |

Without the minimum required coverages, you may also be responsible for the medical expenses of others in an accident.

Liability Coverage (25/50/20)

Liability coverage addresses bodily harm and property damage during accidents. The state minimum coverage limits for Illinois are $25,000 per person and $50,000 per accident for passenger bodily injury liability. The limit for property damage liability is $20,000 per accident.

These state minimum limits may not be adequate for serious accidents. Speak to your insurance company for more information about increasing your financial protection.

These funds cover medical bills and funeral expenses in the event of a death. They also fund repair costs for those affected by the at-fault driver, providing a legal defense if the affected parties file a lawsuit against you.

Uninsured/Underinsured Motorist Bodily Injury Coverage (25/50)

Uninsured motorist coverage pays for bodily injuries sustained during an accident with a driver with no or inadequate insurance. It also applies to claims after accidents with a hit-and-run driver. You may avoid being stuck with crippling medical bills for accidents that aren’t your fault.

Keep in mind that standard uninsured/underinsured motorist coverage doesn’t cover property damage. You still face financial risks if someone without insurance damages your car.

Optional Illinois Car Insurance Coverages to Consider

Your insurance company can advise you on the best optional coverage. Illinois auto insurance requirements don’t include optional coverages, but going beyond the state minimum gives you better protection against the unpredictable.

Consider Collision Insurance

Collision insurance protects vehicle owners by covering damage from collisions with other cars and stationary objects such as utility poles or trees. However, this policy does not cover damage caused by animals.

Opt for Comprehensive Coverage

Comprehensive coverage also applies to your car but covers things like collisions with animals or environmental hazards, vandalism, or theft. Some policies extend this coverage to car rentals.

When combined with collision insurance, you have full coverage.

Full coverage auto insurance is a good idea for anyone who:

Drives a car worth more than the minimum limit for property damage liability

Frequently encounters deer or other wild road hazards

Lives in an urban area with tighter streets where minor collisions are common and cause damage that won’t meet your premium

Is concerned about severe weather hazards and damage from hail, wind, or flooding

Uninsured/Underinsured Motorist Property Damage

It’s also recommended that you add coverage for property damage caused by an uninsured or underinsured driver. This coverage applies to your car and other property that may be impacted during such an accident.

Understand Medical Benefits

Medical Payments coverage (MedPay) is available to fund other drivers’ medical expenses after an accident.

Each insurance provider offers a different limit, typically between $5,000 and $10,000.

Accident Forgiveness Can Help

Your insurance company may offer accident forgiveness. This ensures your insurance premium won’t go up after an accident.

The Benefits of Roadside Assistance

Roadside assistance insurance uses satellite data from your cellular phone or car’s navigation system to alert a law enforcement officer to accidents. It also allows you to call for help for non-emergency car troubles.

SR-22 and High-Risk Drivers

Illinois has legal requirements for drivers deemed high-risk. This is called SR-22 Insurance. Drivers need to maintain this coverage if they are convicted of a DUI or have been in several serious car accidents.

You must also have this coverage if your license is suspended more than once. Finally, uninsured drivers who cause an accident may later need to obtain Illinois SR-22 insurance to drive legally again.

Penalties for Driving without Auto Insurance

Driving without auto insurance in Illinois leaves you vulnerable to legal trouble. In Illinois, you risk fines from $500 to $1,000. You may also have your driving privileges revoked for up to three months.

In severe cases, you risk jail time of up to a year.

However, operating a vehicle without Illinois’ state mandatory liability insurance also puts you at risk for personal financial consequences.

As an uninsured motorist (or one with poor coverage), you’re at risk for significant expenses after an accident. Insurance covers these costs, so you don’t have to come up with the actual cash to pay for medical or repair bills.

Even if you have liability auto insurance, a state minimum policy may not be enough to protect you from harm. Many cars now cost over the minimum limit of $20,000 for property damage liability.

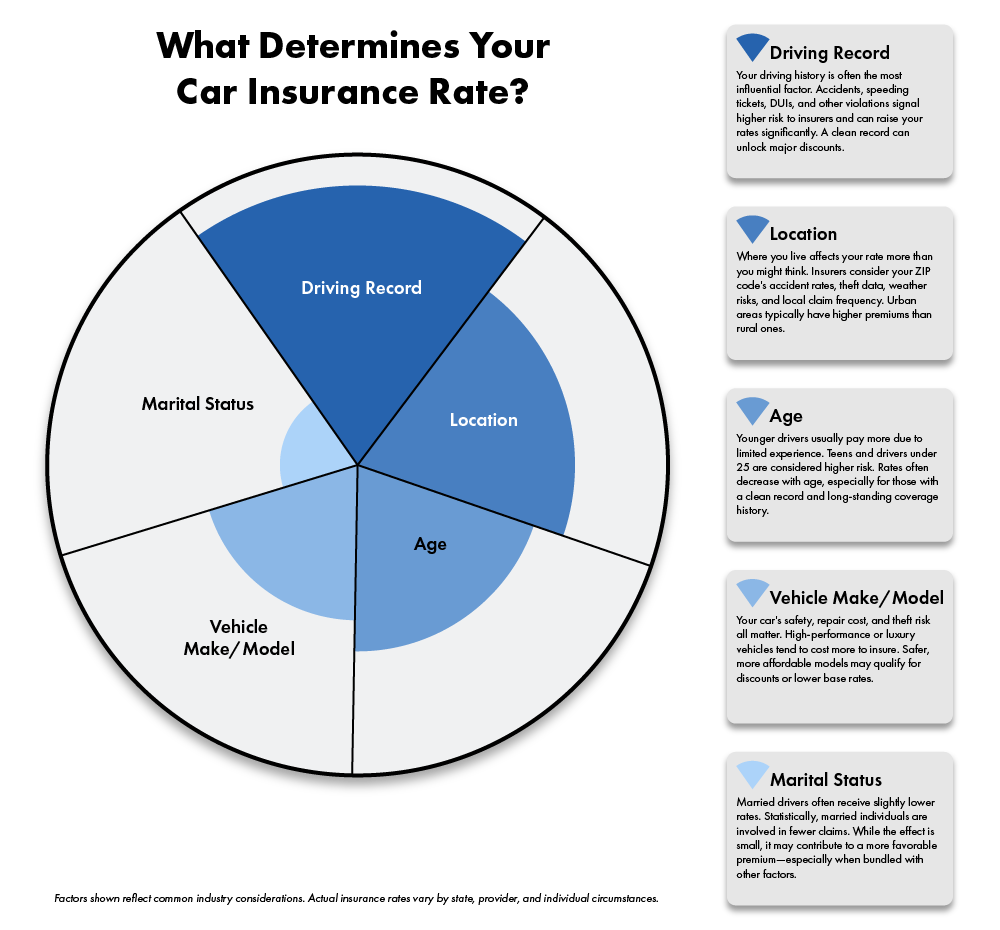

How Your Car Insurance Rate Is Calculated in Illinois

Everyone pays different rates to meet Illinois auto insurance requirements. Factors such as the type of vehicle you drive and where you live can affect your car insurance rates. For example, cars with robust safety features cost less to insure. Conversely, new cars have higher insurance fees than old cars.

Your financial standing and characteristics, such as marital status, also impact the rate. Your credit score is often a factor in the cost of insurance, and those with poor credit scores may pay double what others do.

The most significant influence on insurance rates is your driving record. Your car insurance rate may go up if you rack up traffic violations. Not every insurance company offers accident forgiveness, so these incidents on your driving record can increase your insurance premium.

Safe driving is essential to keep your rates low, but accidents still happen. That’s why it’s vital to consider the different types of insurance coverages to protect yourself financially. Speak with your insurance agent to find out what upgrades are available in terms of:

Physical damage coverage

Medical payment coverage for you and others

Lost or stolen car coverage

Illinois auto insurance requirements only mandate liability insurance policies, but additional coverage can help you with vehicle repairs and medical bills in various circumstances.

How To Save Money While Insuring Your Vehicle

There are several ways to lower the cost of meeting Illinois auto insurance requirements. The best option is to compare local insurance companies for competitive and transparent pricing. Insurance Navy is the best choice for Illinois drivers.

Other ways to save money include improving your credit score and maintaining a clean driving record. By changing your status as a risky customer, you’ll be more likely to find a better deal on insurance.

Safe driver discounts usually apply to those not involved in an accident for a designated period.

Some automobile insurance companies also offer policy bundling. By combining different types of insurance policies, you may get a discounted rate. Usually, car insurance is bundled with renters or homeowners insurance.

Paying your premium in full for your car insurance policy is also a great way to save money. Many insurance companies will offer a discount if you can pay six months in advance. This assures the insurance company that you can’t miss any payments, and they’ll often charge you less as an incentive.

Get Started Today With a Free Car Insurance Quote

With Insurance Navy, you can find the best policy for your budget. We offer thorough coverage at affordable rates. Explore free Illinois car insurance quotes online and learn which optional policies are worth purchasing.

Trust our team to help you meet Illinois auto insurance requirements and receive superb customer care. Our expert insurers are passionate about keeping you and your car safe with a flexible policy tailored to your needs.

Visit one of our Illinois locations or call us at (888) 949-6289 to get started today.