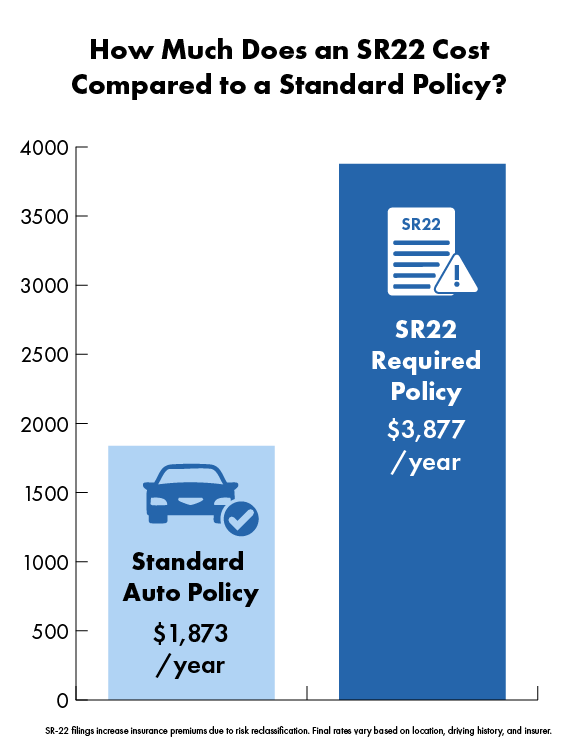

SR-22 insurance is much more expensive than regular car insurance.

On average, SR-22 Insurance costs $3,877 a year, almost double the cost of standard car insurance.

California has the highest SR-22 insurance, at $7,806 a year, and New Hampshire has the cheapest, at $2,285 yearly.

Despite the high cost of SR-22 insurance, the premium increase is not due to the SR-22 form filing itself but the reason for the SR-22 requirement.

The filing of the form is a small administrative fee of around $20. But if you need an SR-22, you pay $2,004 more yearly for auto insurance.

The increased amount depends on the violation that triggered the SR-22 requirement. If you need an SR-22 certificate because of a DUI, you pay more for car insurance primarily because of the DUI, not the SR-22 itself.

Why is SR-22 Insurance so Expensive?

SR-22 insurance is expensive, NOT because of the SR-22 filing, but because of the high-risk driver who needs it.

An SR-22 is not a type of insurance but a certificate that proves to the state that a driver carries the states minimum required coverage.

It's usually required after a serious traffic violation such as a DUI, reckless driving, multiple at-fault accidents, or no insurance. Since these infractions mean a higher risk, insurance companies charge more to cover those drivers.

Insurance companies look at your driving history, and those who need an SR-22 are considered more likely to file claims.

Some insurance companies won't insure high-risk drivers, but others specialize in policies for those who need an SR-22 certificate. Since insurers expect more claims from high-risk drivers, they offset their risk by increasing rates for SR-22 insurance.

The actual SR-22 filing costs only a small filing fee of around $20.

How Much Does SR-22 Insurance Cost?

The cost of the SR-22 itself is very low, with a one time SR-22 filing fee typically between $15 and $50, depending on the state and the incident.

Most drivers pay around $25 for the SR-22 filing. This covers the administrative cost of the insurance company submitting the form to the state. In most cases, this is a one-time fee, and you won't have to pay it again unless your policy lapses.

If your policy lapses, you'll need your insurer to file a new SR-22 form. You'll have to pay the filing fee again when getting a new auto insurance policy.

The filing fee is low, but the actual higher cost comes from the increased car insurance rates caused by the traffic violation that caused the SR-22 requirement.

On average, SR-22 drivers see their rates go up by 14%. Still, they can range from 2% to 187% depending on location, driving record, and nature of the offense.

For example, in California, an SR-22 can nearly double your car insurance rates, while in Oklahoma, the rate increase is roughly 50%.

For drivers with a DUI, the cost for SR-22 insurance is high, around $323 a month or $3,877 a year. There is no “set in stone” increase. Auto insurance rates are calculated based on various factors, including your driving history, type of vehicle, and your zip code.

Driving violations that show high-risk driving behavior, such as DUIs, multiple at-fault accidents, or reckless driving, will almost always cause higher rates.

Some insurers may also require SR-22 drivers to pay the full insurance premium upfront for 6 months instead of monthly.

High-risk drivers are a greater financial risk to insurers. Requiring full payment helps reduce the risk of a canceled policy or lapse.

The easiest way to know how much SR-22 insurance will cost is to get a personalized auto insurance quote.

How Does SR-22 Affect Car Insurance Rates in Different States?

SR-22 car insurance rates for drivers needing an SR-22 vary by state, with some states only adding a slight increase and others a large one.

For example, North Carolina drivers needing an SR-22 see an average auto insurance rate increase of 323% per year.

In comparison, Massachusetts drivers sees an average increase of 112% per year.

We've looked at SR-22 insurance costs in all 50 states and DC and found a wide range of annual premiums.

New Hampshire has the lowest average cost, at $2,285, and California has one of the highest average costs, at $7,806. If you live in a high-cost state like Michigan, California, or North Carolina, finding cheap SR-22 insurance is even more critical.

Some states require an SR-22 even if you don't own a car or before you can reinstate a suspended license. In those cases, a non-owner car insurance policy might be cheaper to meet state minimum requirements.

The SR-22 filing fee is only $25, but the increase in car insurance premiums makes shopping around for the best rates essential.

We can help you find SR-22 insurance rates in your state!

Contact us today to get the Cheapest SR-22 insurance coverage thats right for you.

Who Needs an SR-22 and Why?

"SR" stands for "Safety Responsibility."

An SR-22 is needed for risky drivers convicted of serious traffic violations. It must show the state they are maintaining the necessary insurance coverage while working to regain good standing.

Not a type of auto insurance, an SR-22 is often required to reinstate driving privileges after a suspension or revocation.

Each state has different SR-22 requirements; some, like Delaware, Minnesota, New Mexico, New York, North Carolina, Oklahoma, Kentucky, and Pennsylvania, don't require them.

However, the circumstances that trigger an SR-22 can vary in the states that do.

The most common reasons a court or state might require an SR-22 are listed below.

DUI/DWI Conviction - A DUI often results in a drivers license suspension, large fines, and mandatory SR-22 filing before you're allowed to get your license back.

Reckless or Negligent Driving - Convictions for reckless driving, speeding 30 mph over the limit, or other major traffic violations can require an SR-22.

Multiple Traffic Offenses - Getting multiple driving violations in a short period of time can classify a driver as high-risk. They'd be required to get an SR-22 to keep their drivers license.

Driving Without Insurance - If caught driving without liability insurance, the state may require an SR-22. This guarantees the driver carries the required state minimum liability insurance.

Being Involved in an Uninsured Accident - If you are involved in an accident while uninsured, an SR-22 may be required before your drivers license can be reinstated.

License Suspension or Revocation - Many states require an SR-22 as proof of financial responsibility to reinstate a suspended or revoked drivers license.

Applying for a Probationary Permit or Hardship License - Some states require an SR-22 to get limited driving privileges during suspension.

Outstanding Child Support Payments - Sometimes, a court may order an SR-22 for drivers who have failed to meet court ordered child support payments.

The SR-22 filing period varies by state and violation, typically three to five years.

If an auto insurance policy lapses during this time frame, you'll have to restart the filing period and may face additional penalties.

Also, Florida and Virginia use an FR-44 instead of an SR-22 for certain alcohol-related offenses. The FR-44 requires higher liability limits than the SR-22.

Since each state has different SR-22 requirements, check with your state's DMV or a licensed insurance provider to find out what you need.

How to Get Cheap SR-22 Insurance Quotes

Finding Cheap SR-22 insurance with Insurance Navy makes the process easy!

Getting car insurance after an SR-22 requirement can be challenging since car insurance rates are high for three to five years after a major traffic violation.

However, there are ways to cut insurance costs and find the best rates during and after the SR-22 period.

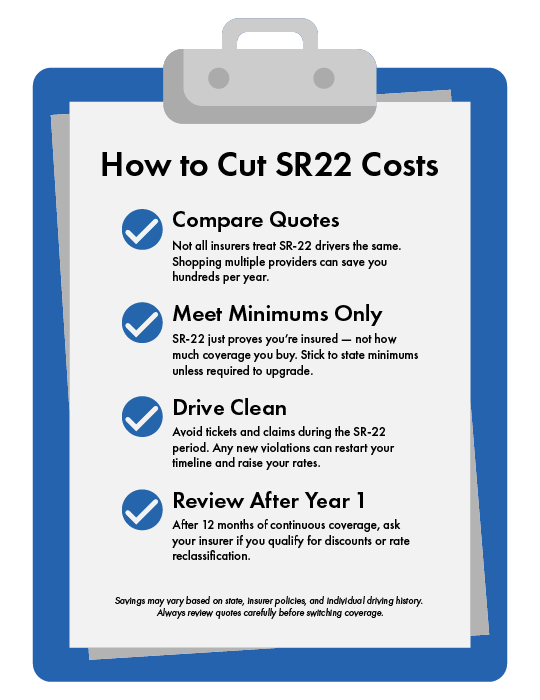

Compare Multiple Insurance Quotes

One of the best ways to lower SR-22 insurance costs is to shop around and compare car insurance quotes from multiple insurance providers.

Insurance companies assess risk differently, so the cost of the same violation can vary significantly from one company to another.

For example, one auto insurance company may increase rates moderately for a DUI, while another may charge more. You can find the company that offers the best rate for your situation by getting multiple insurance quotes.

When getting a car insurance quote, make sure to ask if the insurance company offers SR-22 filings and ask about any possible discounts.

Some insurance companies offer lower rates for bundling multiple policies, having a clean driving record after the SR-22, or after taking a defensive driving course.

Follow State Minimum Insurance Requirements

The DMV or court who mandated your SR-22 requirement will tell you the minimum auto insurance coverage you must have. This way, you can compare multiple policies that meet the state legal requirements and also fits your budget.

If you live in a state with lower than average auto insurance costs, you may even be able to afford higher coverage limits for the best protection.

Maintain a Clean Driving Record

SR-22 insurance costs decrease when you don't get more traffic tickets or cause at-fault accidents. Good driving behavior can lower your risk profile in the eyes of your insurance company. This can possibly reduce your insurance premiums after the first year of your new policy.

Review Your Options

At the end of your first year with an SR-22, request a new quote from your current insurer. If they don't offer a lower rate, shop with other insurance companies to see if they can give you a better price.

Insurers adjust their rates based on risk assessment models. Switching companies can save you money as you get closer to the SR-22 expiration date.

SR-22 insurance is initially expensive, but following these tips can help you find the cheapest coverage and lower costs.

What is Non-Owner SR-22 Insurance?

If you need an SR-22 but don't own a vehicle, Non-owner SR-22 Insurance is the way to go. This type of policy covers you as a driver when driving someone else's car so that you can meet your SR-22 filing requirements without a standard auto insurance policy.

Is Non-Owner SR-22 Insurance a Cheaper Option?

Yes, non-owner SR-22 insurance is cheaper than a regular SR-22 policy. You'd think driving someone else's car would be more risky. Still, non-owner insurance policies are cheaper because you use the car less.

Since you don't have daily access to a car, you're on the road much less, which means fewer chances of filing a claim. So, non-owner SR-22 insurance is cheaper than a standard policy.

Why Should I Get Non-Owner SR-22 Insurance?

Non-owner SR-22 insurance is an excellent option for those without a vehicle, especially after a license suspension or revocation. Many people sell their cars in such situations, so a standard car insurance policy isn't necessary.

A non-owner insurance policy ensures you have proof of insurance when borrowing a car for occasional use, like when driving a friend's or family member's car.

But there are some restrictions to keep in mind. You're not eligible for a non-owner SR-22 policy if:

Someone in your household owns a vehicle you have access to.

You must use an ignition interlock device as part of your reinstatement process.

How to Get Non-Owner SR-22 Insurance

Finding non-owner SR-22 insurance is the same as finding a regular SR-22 policy.

Compare quotes from multiple insurance providers to get the best rate, and make sure the insurance company you choose offers SR-22 filings in your state. This budget-friendly option will help you meet state requirements while lowering car insurance costs.

Get A Free SR-22 Quote Online Today!

Driving without insurance can lead to large penalties and financial ruin if you get into an accident.

At Insurance Navy, our agents help drivers get cheaper SR-22 insurance. Whether dealing with a DUI or other serious traffic violations, getting the right SR-22 policy is key to getting a better driving record.

Call us at 888-949-6289 to speak with an insurance agent or get a free online quote today to find the best car insurance coverage at the cheapest rates.