You could be given similar-priced car insurance quotes from many auto insurance companies if you're looking for cheap auto insurance rates. Many individuals want to lower their car insurance rates, but they are unsure how to do it. The truth is that the majority of motorists are unfamiliar with what factors influence the cost of car insurance rates.

If you're unfamiliar with how car insurance rates are determined, you're not alone. Many individuals are perplexed as to why car insurance rates are so high. The fact is that there are many factors that influence your car insurance rates.

Here are some of the most significant factors that impact the overall cost and price range of your car insurance rates.

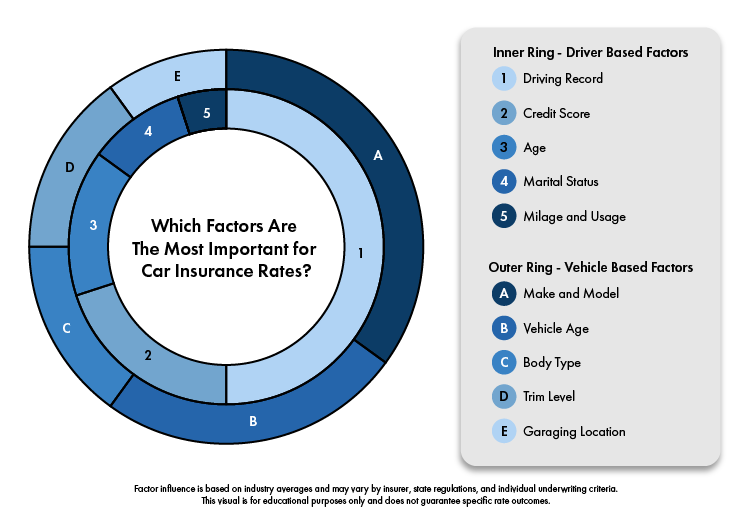

Which Factors are the most important for Car Insurance Rates?

Car insurance rates are determined by a bunch of things called rating factors which are characteristics of the policyholder and the vehicle. These factors are used to calculate the premium, determine risk profiles and price car insurance rates.

Some factors like driving history and vehicle type have a bigger impact on the premium while others like gender or marital status have a smaller impact. Below are the main rating factors in determining your car insurance rate used by insurers, divided into driver and vehicle.

Driver Based Rating Factors

Auto insurers assess personal details about drivers to determine risk. Some factors like age or driving history can change over time, others can’t.

Age

Age is a big factor especially for younger drivers. Teen drivers pay the highest rates because they are more likely to have at-fault accidents and reckless driving behavior. For example the difference in rates between a teenage driver and a senior driver can be over $5,500 a year.

Credit Score

A clear indicator of a driver's risk is shown in their credit score. The difference in rates between a poor credit score and the highest credit score can be over $1,500 a year. But states like California, Hawaii, Massachusetts and Michigan have banned or restricted the use of credit-based insurance scores in rating.

If you've kept a good credit history of paying your bills and repaying debts, car insurance companies will be more inclined to give you a lower rates on your car insurance policy.

Driving Record and Claims History

If you have a traffic violation on your driving record, you will pay higher rates for auto insurance. Driving records are permanent. For example a DUI can result in big rate hikes because you are considered a high-risk driver. If you keep a clean driving record, your previous driving infractions will have a lesser influence on car insurance rates.

You'll notice that your car insurance rates decrease over time as long as you drive safely, avoid accidents, and maintain a clean record.

Location and State

Your zip code and its specific risk factors will have an effect on your car insurance premiums. For example Michigan’s no-fault insurance system has unlimited Personal Injury Protection (PIP) which drives up the cost compared to neighboring states.

Rural areas generally have lower rates than urban areas because of lower risk of accidents, theft and natural disasters. Higher crime, accidents, and risks of natural disaster lead to higher auto insurance rates for drivers.

Personal Factors - Marital Status, Occupation, and Gender

Things like age, marital status, occupation, and gender all play a role in determining your car insurance rates.

For example, younger drivers and unmarried men are more likely to get into a car accident and file a car insurance claim. This is due to the fact that young drivers lack experience and single people, in general, are the only ones driving their car, thus raising their chances of an accident. Female drivers are usually safer drivers, so their insurance rates are lower than male drivers.

Married drivers often get slightly lower rates because of shared driving responsibilities and fewer claims.

Vehicle Based Rating Factors

Unlike personal factors, vehicle based factors offer more opportunities to adjust, so policyholders can control their premium.

Type of Vehicle

If a car lacks essential safety features like anti-lock brakes or airbags their absence will affect your car insurance premium.

Additionally, higher-end cars or those cars with rare parts are costlier to insure since cost of repairs are typically more expensive than typical vehicles. In addition, luxury cars have more of a risk of being stolen than small cars.

To save money on your auto insurance premiums, get a car with a good safety rating and anti-theft features. It might be costly in the beginning, but you’ll save more money down the road on car insurance rates.

Annual Mileage and Use of Vehicle

If you travel long distances on a regular basis, your car insurance premium will come with a greater price than that of individuals who only drive their vehicles for weekend excursions. The fewer miles you drive your vehicle annually, the lower your car insurance premiums will be.

Deductible and Coverage type

As a general rule of thumb, the higher your auto insurance deductible (the amount you pay in the event of a car insurance claim before the insurance provider pays out) then the lower your car insurance premiums will be.

Minimum Liability coverage typically has the lowest rates, but does not cover repairs to your vehicle in case of an at-fault accident.

The different types of coverage you add to your auto insurance policy will also increase your auto insurance rates.

Ownership Status

Premiums also vary if the vehicle is owned outright, leased or financed. For example financed vehicles require comprehensive coverage which increases your car insurance cost compared to owned vehicles.

How to Save on Car Insurance Rates

While some rating factors like age or location are out of your control, there are ways to reduce your car insurance cost:

Compare Quotes: Get multiple quotes from different auto insurance companies to see the difference in price.

Be careful with filing Claims: File fewer claims to avoid premium increases especially if repairs are less than the deductible.

Adjust Coverage: Drop collision coverage or comprehensive coverage for older vehicles to save money on your rates.

Maintain Continuous Coverage: Lapses in coverage will increase rates. Consider a non-owner auto policy if you don’t own a vehicle now.

Check for Discounts: Bundling, good driving record or telematics program can give you discounts but savings may be smaller than other factors.

By understanding and managing these rating factors, drivers can make informed decisions to get lower car insurance premiums from your insurance company.

Speak with an Insurance Navy insurance agent today to see how you could get cheap car insurance quotes today.

Insurance Navy helps drivers get the best, affordable car insurance for their vehicle.

Request a free quote today, either online or over the phone, at 888-949-6289. We also provide assistance in person at all of our storefronts. Reach out today and get driving insured tomorrow.