Driving under the influence of alcohol (DUI) or driving while impaired (DWI) comes with major legal consequences. Every state's DUI consequences are different. Many states treat a first time DUI offense as a misdemeanor with some leniency.

Sentencing guidelines fluctuate depending on the state. Some states have mandatory minimum DUI sentences.

Other states leave it for the judge to decide your sentence. Repeat offenders and offenders with aggravating circumstances (high BAC, accidents, endangerment of minors) will get harsher penalties, higher fines, longer license suspensions, and even jail time.

Beyond the legal consequences, a DUI conviction has additional personal and social consequences. You may face strained relationships, employment difficulties, financial difficulties from fines and legal fees, and mental health challenges like anxiety, guilt, and depression.

The emotional toll of a DUI conviction can be overwhelming. Many people feel shame and regret over what they did. Some states include extra penalties like attending a DUI Victim impact panel, education programs, community service, or an ignition interlock device.

A DUI offense (also known as DUI, DWI, or OUI in some states) is when you operate a vehicle with a blood alcohol concentration (BAC) of 0.08% or higher. However, lower thresholds apply by law for commercial vehicle drivers or minors.

A conviction will change your day to day life, increase insurance rates, limit mobility, and have long-term consequences on personal and professional opportunities.

Knowing your state's laws and getting the right legal advice can help you deal with the aftermath of a DUI offense.

The DUI Arrest Process

Getting arrested for DUI offenses is a scary experience, especially for first-timers.

If you get suspected of drunk driving, you will be arrested by a police officer and taken to the nearest police station or jail for booking, which includes being photographed and fingerprinted. The severity of the charge and state laws will determine how quickly you can get out.

In some states, you can get out immediately if someone posts your bail and drives you home.

In other states, you may have to stay in jail until a judge determines the conditions of your release. DUI arrests also automatically suspend your driver's license. Some states like Texas issue temporary restricted licenses so you can have limited mobility.

The amount of bail needed to get out of jail varies depending on the severity of the DUI offense. If you can't afford the bail, you may have to stay in jail until your court date. Knowing the legal process and state laws can help you get through the aftermath of the DUI charges.

DUI Court Appearance: What to Expect

After a DUI arrest, you will receive a ticket or summons with a court date listed on it. Court is mandatory, and if you fail to appear, a judge will issue a warrant for your arrest. If the court date conflicts with yours, you can file a motion to continue.

You will be required to respond to the DUI charge at your court hearing.

Suppose you want to contest the charges and plead not guilty. In that case, the prosecution will present evidence against you, which may include video footage from the officer's dashboard cam or the jail's booking area showing any failed field sobriety tests.

Given the severity of a DUI conviction, it's recommended that you have legal representation. If you can't afford a lawyer, the court will appoint one for you. A good defense attorney familiar with DUI laws in your state can help build a defense and, if successful, get your case dismissed or reduced to a reckless driving charge so a DUI won't appear on your record.

License Suspension and Limited Driving Privileges After DUI Charges

A DUI in any state comes with major consequences. The worst one is the DMV suspending your driver's license.

Even for a first time DUI offender you'll likely lose driving privileges temporarily. The length of suspension varies by state. A first offense is usually 90 days, but repeat DUI offenses can be longer or permanent with license revocation.

Some states do offer a restricted license. That's a limited drivers license that lets you drive for things like going to work, school or rehab.

Those kinds of permits comes with conditions, like having to put an ignition interlock device in your car. In many states, if you refuse to take a breath test, your license gets suspended right away, even if you get found not guilty in court.

Losing your license can have a really negative effect on your everyday life. It makes getting around a real hassle. You'll have to rely on friends, family, or public transportation. The stress & frustration of dealing with a suspended license will add to the emotional strain of having a DUI charge hanging over you. The consequences of drinking and driving will have long lasting legal and financial consequences after the arrest.

Fines, Legal Fees, and the Financial Blow of a DUI Conviction

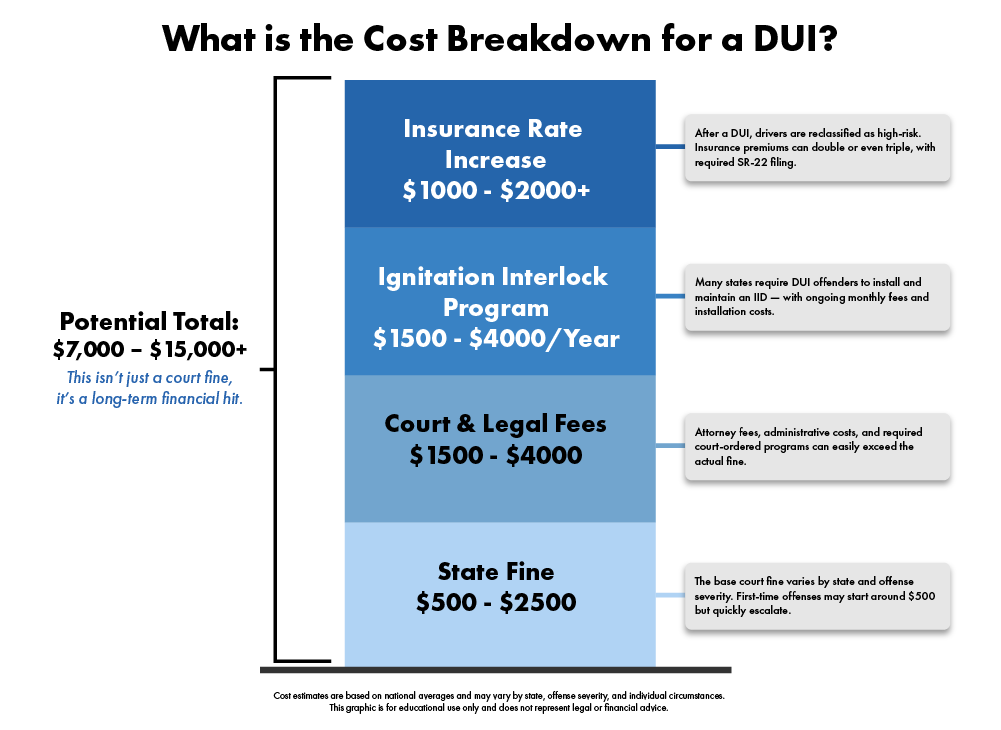

A DUI can cost thousands of dollars, with fines and related fees ranging from $500 to $2,000 or more, depending on the state and circumstances. Every state has minimum and maximum fine structures for DUIs. These can increase if aggravating factors are present, like property damage, injuries, or child endangerment.

A driver convicted of DUI must pay court costs and other legal fees on top of the statutory fines imposed by the state. Many states also require an ignition interlock device (IID) installed in the DUI offenders car at their expense. This device is installed in the vehicle and requires a breath sample before the car can start. If the driver's BAC is above a specific limit, the cars ignition switch is automatically disabled. The cost of installing and paying a monthly maintenance fee on an IID only adds to the financial stress of a getting DUI.

The financial impact of a DUI can be vary large. You'll have to pay increased insurance rates, legal fees, and costs related to license reinstatement or mandatory DUI education classes.

Probation, Jail Time, and Felony DUI Penalties

A DUI can result in probation, jail time, or even prison. This depends on the circumstances of the DUI and state laws. Even if you don't go to jail, you'll likely be put on probation, and the judge will set conditions. The length of probation varies by state.

Probation also comes with extra costs, as you must pay monthly supervision fees. Failure to comply with probation can lead to more penalties, including possible jail time.

Many states have mandatory jail time for DUIs, even for first-time offenders. The sentence is usually short, one or two days in jail. Repeat offenders face much harsher penalties, with mandatory jail time getting longer with each subsequent conviction, sometimes several months or even years in jail.

A DUI can also be charged as a felony, depending on the number of prior convictions and the case circumstances. The threshold for a felony DUI varies by state. Some states make a second DUI within ten years a felony, while others don't raise the charge until the third offense. Felony DUIs often have aggravating factors such as high BAC and accidents causing serious bodily injury or death. In those cases, the offender may face years in prison.

Knowing the penalties for a DUI conviction reminds you of the serious legal and financial consequences of impaired driving and to comply with probation and state laws.

Alcohol Evaluation, Treatment, and Education Programs After a DUI

After a DUI conviction, most courts require the offender to complete an alcohol and drug education program before they can get their drivers license back. These programs are designed to evaluate an individual's alcohol use patterns and determine if further treatment is needed. A trained counselor will do an assessment, usually by asking a series of questions about alcohol use and how it impacts different areas of life.

Based on the evaluation results, the offender may be required to participate in a court-approved alcohol treatment program. These programs will educate on the risks of alcohol abuse and, if needed, treat those who have an alcohol dependency.

For first time offenders, the DUI school program is often the main form of court ordered rehabilitation. For repeat offenders or cases with aggravating factors, these programs are usually required along with additional penalties such as community service, restitution to victims, or jail time.

These treatment programs are an opportunity for the driver to reflect on their alcohol use and make more responsible choices.

DUI for Minors: Zero Tolerance Consequences

Minors charged by law enforcement officers with driving under the influence (DUI) face harsher consequences than adults. Since the drinking age is 21 in most states, minors can be convicted of having any amount of alcohol in their system while driving.

Many states have zero tolerance laws for underage drivers, where the legal BAC limit for drivers under 21 is .02% or 0.00%, meaning any detectable amount of alcohol and you're considered a drunk driver.

Penalties for underage DUI convictions vary by state but usually include automatic license suspension, fines, alcohol education or treatment programs, and hours of community service. Some states have even harsher penalties for minors than for adults, even jail time for a first offense. A DUI conviction can also have long-term consequences, like higher insurance rates, difficulty getting a job, and problems getting into college or particular programs.

Since the consequences of underage drinking and driving are so severe, minors facing a DUI charge should know their state's laws and the impact on their future. Knowing and following these rules can avoid life-changing consequences.

DUI and Auto Insurance: Higher Rates and SR-22 Requirements

A DUI will raise your auto insurance premiums exponentially. You can face higher rates, your policy being cancelled, and new state legal requirements.

Insurance companies consider DUI offenders as high-risk drivers. This means loss of safe driver discounts and much higher rates. Sometimes your insurance rates can double or even triple your previous rate. Some companies will cancel your policy immediately. You'll have to buy policy from a high-risk insurance company, which is way more expensive.

In most states, a DUI conviction requires getting SR-22 insurance. SR-22 insurance is not an actual insurance policy but a certificate of financial responsibility. This document verifies that you meet the state's minimum car insurance requirements, which are required for three years after a DUI conviction.

A DUI will stay on your record for several years, if not forever, so your insurance will remain high even after you've paid your legal penalties. DUIs have long-term financial impacts on getting insurance. DUI offenders often struggle to find affordable car insurance coverage.

Ignition Interlock Devices: Required After DUI Convictions

In many states, if you've been convicted of a DUI, you must install an ignition interlock device (IID) on your vehicle. Some states require this for first-time offenders, and others need it to get a restricted license after a conviction.

An IID is a breathalyzer on the dashboard of your car. You are required to blow into it before the car will start. If the device detects a BAC above the set limit, the car won't start.

The cost of an IID can be expensive. You're responsible for both the installation fee, usually several thousand dollars and the monthly maintenance fee. The device allows you to drive as long as you haven't been drinking. It's an embarrassing reminder of the consequences of drunk driving and keeps you sober on the road.

The Bottom Line

The full extent of the DUI penalties varies by state, but even if this is your first offense, being caught drinking and driving. If you continue this behavior, the consequences will only get worse.

A DUI is an offense that can follow you for the rest of your life. While teens are known for making mistakes, this is certainly one no one wants to make at any age.

Looking for Cheaper Car Insurance after a DUI Conviction? Insurance Navy can give you Cheaper Insurance Rates!

Call one of our insurance agents at 88-949-6289 to see how we can lower your car insurance rates after a DUI conviction. We specialize in DUI Insurance and stand by to help you get back on the road.