You've probably already been told about the importance of your credit score or FICO Score.

When it comes to buying a car and renting or buying a place, your credit score will be one of the determining factors of whether you can. Your credit score acts as an indicator of how likely you are to pay your bills on time.

Credit score directly affects your auto insurance rates. But how do car insurance companies look at your credit rating?

How Does Your Credit Score Affect Your Car Insurance Rates?

Your credit-based insurance score can impact your ability to get auto insurance and how much you pay. The extent of the impact depends on the insurance company and state regulations. Still, insurers may consider credit-based insurance scores when:

Underwriting: Deciding to offer coverage and how much coverage.

Rating or Tiering: Setting the cost of car insurance premiums based on risk.

A good credit score can open up more insurance options and lower premiums. A poor credit history may limit your options or increase rates. But remember:

Insurance scores are different from lending scores. Credit-based insurance scores predict the likelihood of filing costly insurance claims. Credit risk scores, used by lenders, predict the risk of missing a payment by 90 days or more.

Credit is just one factor. While credit history may affect insurance decisions, it can't be the only reason to deny coverage or increase rates.

Several states prohibit or restrict the use of credit reports in auto insurance pricing or policy issuance:

California, Hawaii, and Massachusetts - Prohibit the use of credit-based insurance scores.

Maryland - Credit history can only be used when setting initial rates.

Michigan - Credit history can only be used for installment payment plans.

Oregon - Insurers can only use credit information when setting initial rates.

Utah - Credit history is only used at policy issuance and for the first 60 days of coverage.

What is a Credit Score?

A credit score is a number that represents your creditworthiness and how likely you are to pay back a loan. A higher score means a lower credit risk to lenders and insurers.

A credit score is based on five factors from your credit file:

Payment History: Your history of bill payments.

Amounts Owed: The amount of debt compared to credit limits.

Length of Credit History: Length of active credit accounts from financial institutions.

Credit Mix: Types of credit accounts (e.g., credit cards, auto loans).

New Credit Applications: How often you apply for new credit lines.

Auto insurance companies may consider a lack of credit history the same as a bad credit score and may charge higher premiums. Credit scores range from 300 to 850, and insurers categorize applicants into different tiers based on their scores.

What is a Credit-Based Insurance Score?

You can look at your credit score or FICO score, which includes an accurate record of outstanding debt and payment history, known as credit history and credit report. Auto insurance companies can assign you a credit-based insurance score, which will dictate what your car insurance premiums will be set.

With a feel for your finances, the auto insurance company can score how likely you are to file a claim exceeding your coverage limits.

What Factors Affect Your Insurance Score?

A good credit profile can save you money on insurance. Since insurers look at both the good and the bad in your credit history, you can still get a lower rate even if some parts of your credit profile aren't great.

Favorable Factors that can help your credit-based insurance score:

A long-established credit history

Multiple active accounts in good standing

On-time payments with no late payments

Low credit utilization (using a small percentage of available lines of credit)

Unfavorable factors that can hurt your credit-based insurance score:

Accounts in collections

Frequent late or missed payments

High credit utilization (using most or all of your available credit)

Multiple recent credit applications

Note: These factors vary by state to comply with state regulations.

How Can You Fix a Bad Insurance Score?

While some parts of your credit history (like how long you've had it) are out of your control, there are things you can do to improve your insurance score. Make on-time payments on loans and mortgages, keep accounts in good standing, and limit new credit applications, and you'll see improvement.

Also, look at your credit utilization. If you're using a high percentage of your available credit, it's viewed negatively. Keeping your credit usage low can help your score over time.

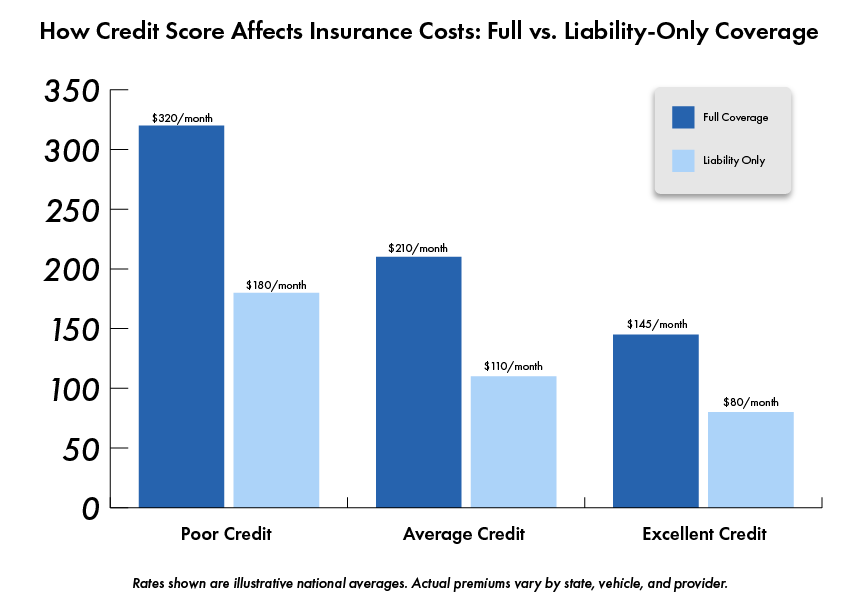

How Do Certain Credit-Scores Affect Insurance Rates?

Let's look at how specific credit scores affect car insurance rates in the eyes of auto insurance companies.

Drivers will pay the following amounts for getting car insurance premiums based on their credit score from the major credit bureaus Experian, Equifax, or TransUnion:

Poor credit score (100 to 580) - Drivers with a poor credit score or FICO score and poor credit history can expect to pay around $2,424 annually for full coverage and $1,008 annually for basic auto coverage costs.

Average credit score (670-739) - Drivers with an average score will pay about $2,076 annually for full coverage and $700 for basic coverage.

Excellent credit score (740 and higher) - Drivers with good to excellent credit scores will pay around $1,555 for full coverage and $545 for basic coverage yearly.

Why Do Insurance Companies Check Credit Scores?

Insurers use credit-based insurance scores because they believe they help measure risk. By predicting the likelihood of claims exceeding premium payments, insurers can distinguish between low-risk and high-risk policyholders.

A 2007 Federal Trade Commission (FTC) study found that credit-based insurance scores are good predictors of risk for auto policies. The study also noted that while these scores are distributed differently by race and ethnicity, the correlation with race and ethnicity only partially contributes to their predictive power.

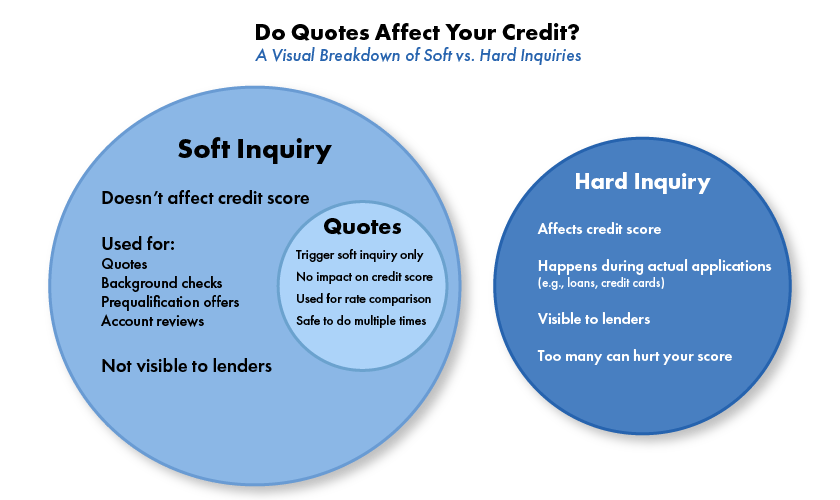

Do Insurance Quotes Affect Your Credit Score?

Requesting an insurance quote does not hurt your credit-based insurance score or overall credit score. When an insurer does a credit check, a soft inquiry is recorded on your credit report, which doesn't affect your credit score.

However, hard inquiries associated with loan applications can lower your credit score slightly. Since insurance quotes only generate soft inquiries, you can compare rates regularly without harming your credit and find the best coverage at the lowest price.

What Other Factors Besides Credit Rating Affect Car Insurance Rates?

Let's look at what else determines your auto insurance rates with major car insurance companies so you can get a feel of how each factor will play into your auto insurance premiums and why they are essential.

In addition to credit scores, there are several other personal factors that potential car insurers will look at before you purchase a car insurance policy with them.

Factors your car insurance company will look at are listed below.

Driving record - It's common knowledge in the car insurance industry that the safest drivers will receive the lowest auto insurance rates because they are less likely to file claims often. Auto insurance companies look at driving history to see how good your driving habits are. A clean driving record leads to cheaper rates.

Place of residence - Car insurance companies can consider crime statistics and population by looking up your zip code. People in large urban areas who are more prone to crime will see higher car insurance premiums on average than those living in rural communities.

Type of Vehicle - Different makes and models of vehicles have their car insurance rates. For example, a sports car will cost more to insure than a sedan. Older cars' insurance costs may be lower. However, if they are over ten years old, they will need a special kind of auto insurance policy.

Age - Younger and newer drivers must pay higher average auto insurance rates than older, more experienced drivers. With no prior driving record, history, or experience, car insurance companies have no choice but to assume that these drivers will be high-risk level drivers when calculating their car insurance premiums.

Gender - More common knowledge in car insurance is that women pay lower car insurance premiums than men.

Marital status - Because married couples are more financially stable, they pay lower car insurance premiums for their cars. Often, they are listed on the same auto insurance policy.

How much car insurance coverage is desired - The auto insurance coverage and the types of insurance policies you wish to buy directly affect your car insurance costs. For car insurance, there is basic coverage and full coverage. Basic car insurance refers to carrying liability auto insurance, while full auto insurance covers comprehensive and collision insurance. The more car insurance coverage you want, the more your auto insurance premium costs.

How to Get a Better Credit Score For Lower Car Insurance Rates

While your credit-based and insurance-based scores are two different things, they directly affect each other -if one is high, so will the other. The good news is that improving your credit or FICO score is entirely in your hands.

Tips to improve your credit score or FICO score are listed below.

Make your credit card payments on time - Pay off your account and credit card balances within the month you accumulate them. Staying on top of your bills is the best way to show financial reliance and stability, increasing your credit score. Late payments will have the opposite effect.

Make your account current - This should be done to catch up on your credit card bills. You must make a payment that satisfies the past balance from the previous month or make a minimum payment for the current month. These payments are due after a specific date; your credit card providers tell you you must keep your account current.

Handle debt with regular payments - If you find yourself in credit debt, the best way to handle it is to gradually chip away at it with regular payments. Debt can follow you for years, so you want to avoid it.

Monitor your credit report - You don't always have to monitor your credit report, but you should check it at least once a year.

Review Your Credit Report and Compare Auto Insurance Quotes

You won't get a credit-based insurance score. Still, you can access your credit report from TransUnion or LexisNexis and dispute any errors. Insurance companies can't change your credit report. Still, they will recalculate your credit-based insurance score if corrections are made to your report.

You are entitled to a free credit report under the Fair Credit Reporting Act (FCRA). Suppose you find errors or have been a victim of identity theft. In that case, you can dispute and correct them to ensure your credit history is accurate.

You can also use Insurance Navy's auto insurance comparison tool to compare quotes from top insurance companies. This tool will also help you switch policies and get a partial refund from your old provider.