If you've been convicted of a DUI or DWI, you may have heard of FR44 and SR22 filings.

While they serve the same purpose, they are two different insurance filings, and depending on your situation, you may need to get one to keep or reinstate your driving privileges.

Knowing the difference between SR22 and FR44 will help you comply with the state laws and be able to drive legally.

What is an FR44 Form?

FR-44 forms are similar to an SR-22 Form except for a few minor differences.

Only Virginia and Florida require FR44 filings. Although often referred to as "DUI insurance," an FR44 is not an insurance policy but a certificate showing a driver has the required insurance coverage to meet the state's financial responsibility requirements. Individuals convicted of a DUI or DWI must get an FR44 as part of the process to reinstate their driver's license.

It’s the policyholder's auto insurance company that is responsible for filing the FR44 certificate. The company will submit the required documents to the state regulatory agency, such as the Department of Motor Vehicles (DMV).

FR-44 forms are only used in Florida and Virginia, while SR-22 is used in other states.

The minor difference is the minimum coverage you're expected to carry; the two forms function similarly. An FR-44 is proof of financial responsibility, just like an SR-22 certificate.

Who needs a FR44?

In Virginia, high-risk drivers may need to file and maintain FR-44 insurance for three years after a serious traffic violation, including:

Causing maiming injuries while driving under the influence

Operating a vehicle under the influence of alcohol or drugs

Driving with a revoked license due to a previous conviction

Violating federal, state, or local laws similar to the above driving offenses

In Florida, an FR44 is required for anyone convicted of DUI or driving under the influence of drugs. This certification is required to reinstate a driver's license and must be maintained for three years.

How much does a FR44 cost?

The filing fee for an FR44 certificate is usually between $15 and $25. However, the actual cost of an FR44 insurance policy will depend on many factors, including the driver's age, location, and vehicle type.

Since individuals who need an FR44 are considered high-risk drivers, they are required to carry higher minimum coverage limits, which means higher insurance premiums. In Virginia, drivers filing an FR-44 certificate must carry 100/200/50 liability coverage, which is double the state's minimum limits according to the Virginia DMV.

Difference between SR22 and FR44 Insurance

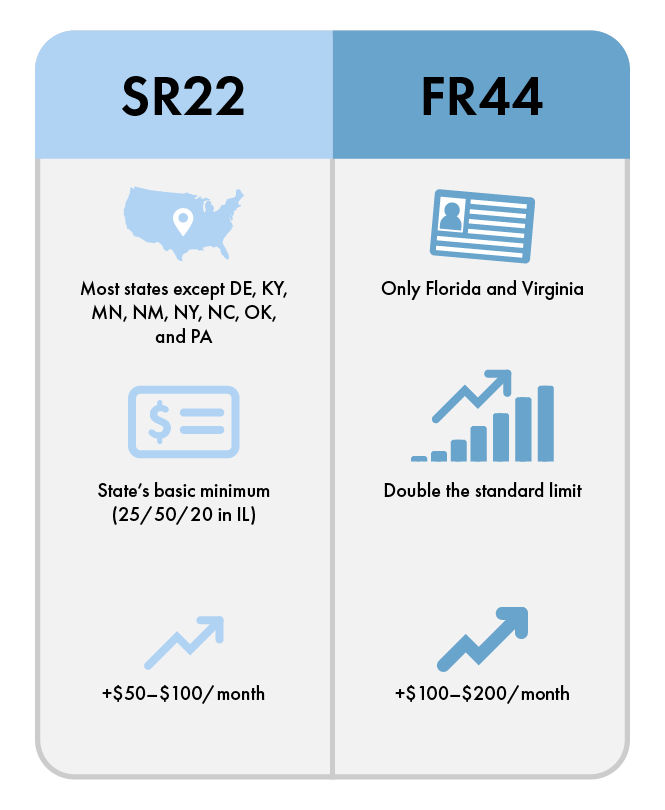

The main difference between SR22 and FR44 is the insurance coverage. While they are proof of financial responsibility, FR44 requires much higher liability coverage, making it more expensive than an SR22. Knowing the difference will help you stay legal and comply with state laws after a DUI or DWI conviction.

What is an SR22 Form?

An SR-22 is not a type of insurance, it is a certificate for high-risk drivers to prove they carry the minimum required liability insurance their state requires.

The SR-22 stays on file with their state's DMV for a period of time, usually three years, while their license is reinstated. SR-22 certification is a nationwide practice since 48 out of 50 states have liability insurance requirements for their drivers.

When Will You Need an SR-22 or FR-44?

SR-22 or FR-44 insurance or certification is required when a driver has been labeled high-risk by an insurance provider after a significant traffic violation. These violations often lead to driver's license suspension and marks on a driving record.

These driving violations that lead to SR-22 requirements are listed below.

Driving under the influence (DUI)

Driving without insurance

Driving without a license

Several speeding tickets or traffic violations and reckless driving

Car insurance fraud

Cases of vehicular manslaughter

Even if you don't own a car, you must purchase a non-owner car insurance policy to file an FR-44.

What is State Minimum Liability Coverage?

One last prerequisite to be aware of is how much the liability coverage requirements of your state are.

In most of the United States, drivers are required to carry auto insurance coverage that can pay for damages and injuries they cause to another driver in an at-fault accident. This state mandatory liability insurance is often referred to as basic car insurance.

For example, according to the Virginia DMV, Virginia requires drivers to carry $50,000 in bodily injury liability coverage per person, $100,000 in bodily injury liability per accident, and $25,000 in property damage liability coverage per accident (50/100/25) as of January 1, 2025.

Check your state's Department of Motor Vehicles (DMV) website for more information on how much basic car insurance you must buy from auto insurance companies to drive legally.

What is The Process of Getting an SR-22 and FR-44?

You may want the insider scoop on what to do and what to expect when filing an SR-22 and FR-44 certification with your DMV. The process is a three-way effort between you, your insurance provider, and your DMV.

The Steps to getting an SR-22 and FR-44 are listed below.

A violation that results in license suspension can be any of the violations listed in the previous section. The most common are driving uninsured or under the influence.

Insurance company may cancel auto insurance policy - In addition to a license suspension from the DMV, your car insurance provider may cancel your auto policy outright. At the very least, you can expect your auto insurance costs to rise significantly after something as serious as a DUI.

Purchase SR-22 insurance from an insurance company - You purchase SR-22 Insurance with your old insurance company or shop around for another. Insurance agents and companies specialize in high-risk driver coverage, so getting as many quotes as possible is best.

High-risk insurance is purchased, and SR-22 is filed with DMV. Your insurance provider will take it from here once you have a policy and an SR-22 certifying that you do. It may seem redundant, but it's necessary so that high-risk drivers don't commit fraud. The auto insurance company then files the SR-22 or FR-44 with the DMV.

DMV reinstates licenses, and SR-22 is required for up to three years. With the SR-22 on record, the DMV reinstates your license, given that you maintain your financial responsibility coverage and SR-22 for the next three years. During that time, the best you can do is to become a safer driver and pay your insurance premiums on time. Your insurance company will notify the DMV, and your license may be suspended if your policy lapses before the allotted period has expired.

Is There a Different Process For FR-44 Filing?

In Florida and Virginia, the FR-44 process is the same as an SR-22 certificate filing would be anywhere else. The driver's license is suspended, they get new high-risk insurance along with an FR-44, then have it filed with the state's DMV.

However, the one difference in practice between Florida and Virginia is that drivers with FR-44s must carry double the minimum liability limit required. If you live in Virginia, your required coverage limits would jump from 50/100/25 to 100/200/50. These are referred to as high-risk coverage limits.

Does an SR-22 or FR-44 Increase Your Car Insurance Rates?

An SR-22 or FR-44 filing requirement on your driving record will increase your car insurance rates. Those with a suspended license or DUI report an insurance average rate increase of around $500 for their coverage.

To put this in perspective, say you paid $570 annually for liability insurance coverage. After something like a DUI, your new annual premium will be around $1,150. At the same time, another cost for being issued an SR-22 or FR-44 is the license reinstatement fee that the state DMV charges. When your coverage, policy, and SR-22 certification are filed, you'll be issued your license back after paying a reinstatement fee of in the range of $145 to $220 according to the Virginia DMV.

The good news is that there is no annual filing fee for your SR-22 or FR-44. You need to maintain a clean driving record and avoid insurance lapses to reduce your auto insurance rates. SR-22 certification is similar to FR-44 certification. Both can just be equally as expensive, but it is required to have your driver's license reinstated.

Ready for a Fast SR-22 or FR-44 Quote?

Enter your ZIP code below to view quotes for the cheapest Auto Insurance Rates.

Get a Free Online Quote for Affordable Car Insurance, or visit one of our many convenient locations nationwide.