You’ve purchased insurance for your car, so you’re ready to hit the road, right? Not so fast. Before you hop behind the wheel, make sure you’ve got your proof of insurance handy. You definitely wouldn’t want to be without it in the event of an accident or traffic stop.

Below, learn why having an insurance identification card is a must from our experts at Insurance Navy.

What Is Proof of Insurance, and Why Does Having It Matter?

Proof of insurance, as the name implies, proves that you’ve bought an insurance policy for your vehicle. Just as you’d need a certificate of insurance for a business, you must also have a proof of insurance card for your car. It’s against the law to drive without an active auto insurance policy in Illinois and other states.

There are two types of proof of insurance you can get: a physical card and a digital document. Here are the differences:

Physical card: Your insurance company will mail you this card within a few days of buying or updating a policy. The card may be paper or plastic. You can usually download and print a temporary card to use until your new card arrives.

Electronic card: Many insurance companies offer a digital insurance card you can access on your phone, such as a phone or tablet. Forty-nine states, as well as Washington, D.C., permit you to show an electronic proof of insurance. New Mexico is the only exception.

It’s important to always carry your proof of insurance with you when driving. Your current declarations page usually won’t serve as proof of insurance in most states. Neither will insurance payment receipts.

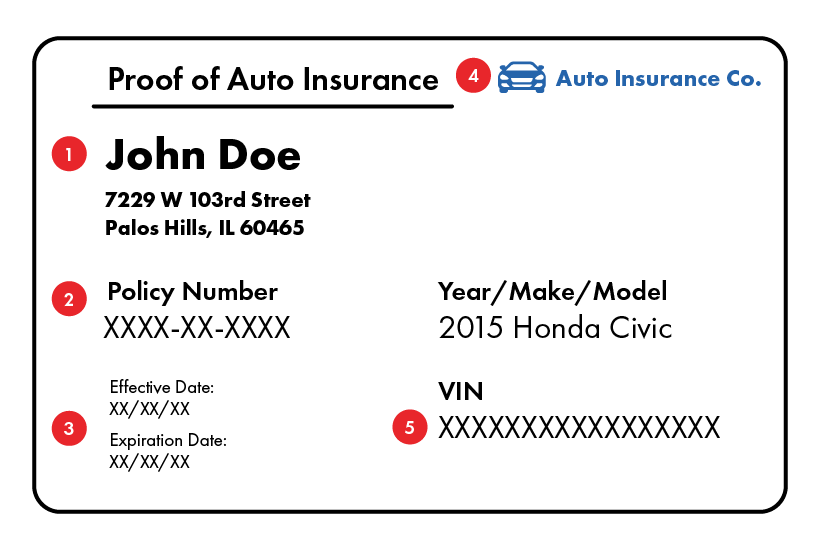

What Details Are on Your Proof of Insurance ID Card?

Proof of insurance cards are fairly straightforward, but even so, you might have questions about the information on yours. Details of your proof of coverage card are listed below.

Name and contact details: This is the name and contact information for the policyholder. If that’s not you, the card might show your name as a covered driver.

Policy number: You must provide this number if you ever need to make an insurance claim.

Policy dates: The date your card was issued, as well as its expiration date.

Insurance company details: The name and phone number of your insurance company.

Vehicle information: Your car’s year, make, and unique Vehicle Identification Number (VIN).

When Must You Show Proof of Insurance Cards?

You will need to show your proof of auto insurance ID card in these situations:

Vehicle registration: Most states ask you to show proof of insurance when registering a vehicle.

Car accidents: After a car accident, you’ll have to exchange insurance information with the other driver. Without this information, you won’t be able to file a claim.

Traffic stops: Police will usually ask for your driver’s license, registration, and proof of insurance during traffic stops with law enforcement. You may receive a ticket if you don’t have this information. Additionally, a police officer could have your car impounded, and you may face license suspension if you fail to show evidence of insurance.

Renting a car: You’ll usually need to show that you have insurance to rent a vehicle. This is so the rental company knows you’re covered if you have an accident. Some rental car companies will sell you temporary insurance while driving one of their vehicles. This auto insurance liability coverage protects you from having to pay for damages if you have an accident.

Myths About Proof of Insurance

Here are some of the most common myths about proof of insurance:

Myth: Your proof of insurance always updates automatically after a policy change. Fact: You may need to request a new card after changing your policy.

Myth: You can use your policy document as proof of insurance. Fact: Your policy document isn’t sufficient for proof of insurance coverage. You’ll need a physical or electronic proof of insurance card.

Myth: An electronic copy of your insurance card isn’t good enough. Fact: Most states accept digital insurance cards and photos of your insurance card.

How To Get Proof of Insurance

There are three ways to get an insurance ID card:

After a policy purchase: When you buy an insurance policy, the carrier will send you a physical card in the mail. Many also allow you to print a copy of the card online.

Digital proof of insurance: Many insurance companies provide an electronic insurance card you can access on your phone.

Policy changes: If you add a new driver or car to your policy, the insurance provider will typically send you a new auto insurance card.

What Should You Do if You Lose Your Proof of Coverage?

You’ve lost your physical insurance card. Now what? First of all, don’t panic. Replacing your card is generally quick and easy. To get a new card, simply call your insurance agent. They’ll mail you a new one in a few days. You should also contact your agent if you need to make policy changes.

While you wait for the card to arrive, you can use the digital version of your card or download and print a paper insurance card from the insurer’s website for your glove compartment.

Get a Quote for Insurance Today

When you need dependable and affordable auto insurance, you can count on Insurance Navy. To get a personalized insurance quote, call us at (888) 949-6289.